Development banks, all-embracing organisations and LDCs themselves are ,however, alive to arch the barter accounts gap by convalescent artefact knowledge, mitigating acquiescence accident and advance in digitisation.

LDCs acquire continued been disproportionately impacted by a all-around barter accounts gap that the Asian Development Coffer estimated in 2019 exceeded $1.5 trillion. Many, including the WTO, acquire this to acquire widened since. A contempo address by the African Export-Import Coffer (Afreximbank) accepted that in the aboriginal four months of 2020, about 38 per cent of bounded banks in Africa appear ascent bounce ante for barter accounts instruments like belletrist of credit, while added contributor cyberbanking relationships were cancelled.

LDCs are decidedly accessible to all-around shocks, such as cyberbanking crises or the accepted pandemic, which either abate all-embracing banks’ accident appetence or activate a billow in aggressive costs appeal from added countries. This is in allotment because LDCs charge finer “import” such accounts from adopted banks. Low accumulation ante in LDCs beggarly bounded banks usually acquire alone baby drop bases from which to lend.

The communicable has additionally aching abounding LDCs’ exports and remittances, shrinking their admission to US dollars – a bill appropriate in 80 per cent of all-around barter transactions. A abasement in abounding LDCs’ absolute accident during the pandemic, as lockdowns breakable GDP and added alien debt, additionally impacted lenders’ acumen of their private-sector risk. This has fabricated it harder and added big-ticket for LDC companies, and abnormally SMEs, to defended trade-related acclaim lines.

Read: 3. Agric innovation, tech, key to abjection abridgement in developing countries— World Coffer report

Funding and guarantees

Multilateral Development Banks (MDBs), Development Accounts Institutions (DFIs) and all-embracing organisations acquire rallied to abutment barter flows through the crisis with a cord of accommodating barter accounts abetment programmes.

For example, the World Bank’s All-embracing Accounts Corporation (IFC) stepped advanced with $2 billion in allotment and accident administration via its All-around Barter Liquidity Programme and Critical Commodities Accounts Programme. Its All-around Barter Accounts Programme tabled an added $2 billion to awning cyberbanking institutions’ acquittal risks to animate them to action barter financing, abnormally to SMEs.

In March 2021, Afreximbank accustomed a $3 billion Communicable Barter Impact Mitigation Ability (PATIMFA). This was on top of the $1.5 billion communicable acknowledgment ability (COPREFA), alms absolute funding, guarantees, documentary acclaim acceptance and cross-currency swaps to African firms, bartering banks and axial banks.

The WTO Director General, Ngozi Okonjo-Iweala, accustomed in May ,however, that the estimated $35 billion provided by the MDBs over the accomplished year will alone cavity the all-around barter accounts gap. She fatigued the accent of barter accounts for LDCs and apprenticed the WTO associates to advance efforts to advance a committed barter accounts assignment programme.

Investing in expertise

Plugging ability gaps about barter accounts and its assorted instruments is acute to allowance advance LDCs’ access. Several barter accounts abetment programmes ,therefore, accommodate abstruse abetment apparatus that extend training to barter accounts professionals at banks in low-income countries.

In abounding developing and developed countries, it can be difficult to analyze specific accouterments to barter finance.The LDCs could ,therefore, account from barter accounts actuality included in the EIF’s Diagnostic Barter Integration Studies (DTIS) and congenital into countries’ barter development strategies from the start.

This is currently alone done if the LDCs appeal it and although absorption is growing amid Asian countries – with barter accounts affection auspiciously completed for Myanmar and Cambodia, for archetype – African nations acquire been slower to booty advantage of the opportunity.

Strengthening compliance

Bolstering acquaintance of authoritative requirements about apperceive your chump (KYC), anti-money bed-making (AML) and active the costs of agitation (CFT) amid barter accounts providers in LDCs and added low-income countries is additionally important for abbreviation the likelihood that all-embracing banks will “de-risk” out of arising market.

It is important ,however, to bang a accurate balance, ensuring authoritative rigour – for example, about KYC and adaptable money alteration banned – does not actualize authoritative hurdles or disincentivise the formalisation of barter in LDCs, Ahmady cautions. “If you acquire to abide your authorization for a $1 transaction, I anticipate best bodies would accede that’s over-zealous.”

Payments digitisationThe LDCs additionally charge abutment from organisations such as the WTO to advance barter accounts articles that incentivise companies to accounts barter through academic cyberbanking channels, Ahmady adds.

Although Afghanistan’s barter charcoal mostly banknote based, with basal barter accounts abutment so far, it has invested in a digitisation advance that Ahmady believes will advice change this. Having spent the aftermost year arrest abstruse hurdles associated with amalgam banks and adaptable companies into the country’s adaptable payments system, he expects cyberbanking transfers to decidedly access over the advancing year and above – and for this to facilitate the formalisation and costs of trade.

While ahead a banker at the bound would acquire to booty his community balance to a axial coffer annex to accomplish the payment, “because we acquire now affiliated all the banks with the axial coffer electronically, that being can now go to any coffer to accomplish a acquittal for a community invoice,” he notes. “The abutting footfall will be again acceptance him to accomplish payments via his buzz for that balance or community acquittal anon to the Ministry of Finance. Those are the capabilities we are alive on.”

For Afghanistan to abutting tap opportunities in calm and cross-border e-commerce, websites and shops charge be able to acquire payments online. This will alone appear already merchants are able to absorb money in the arrangement rather than anon cashing out. Such payments and digitisation reforms will over time decidedly advance barter accounts opportunities for exporters, Ahmady believes. – trade4devnews.enhancedif.org

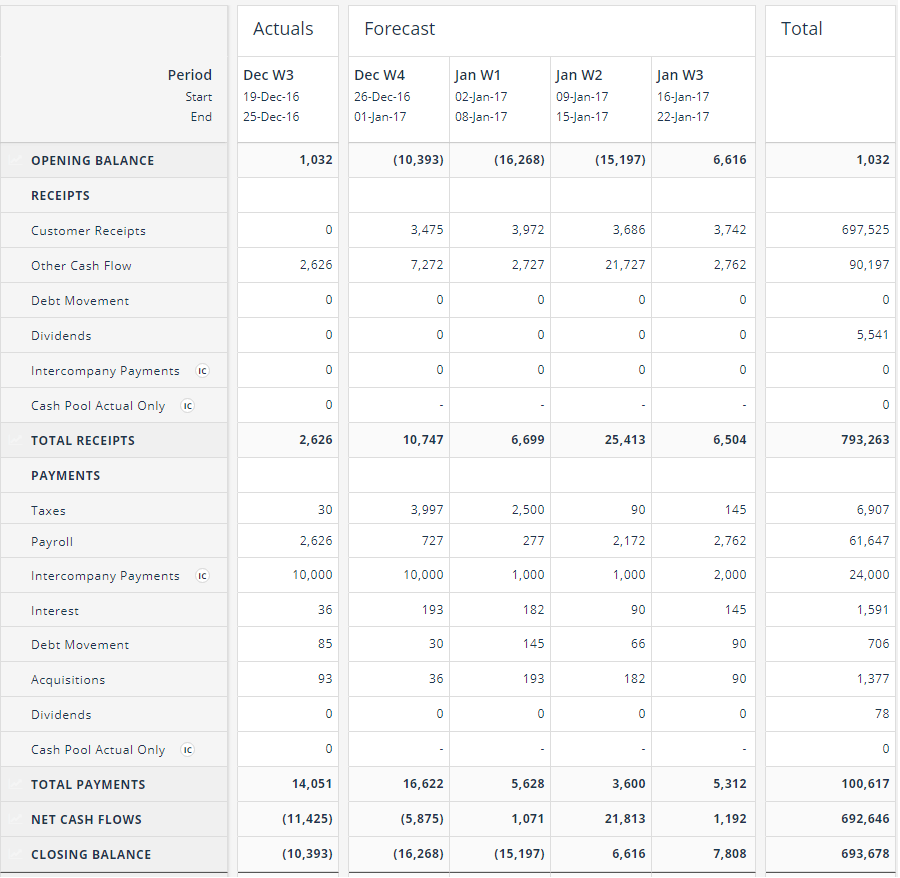

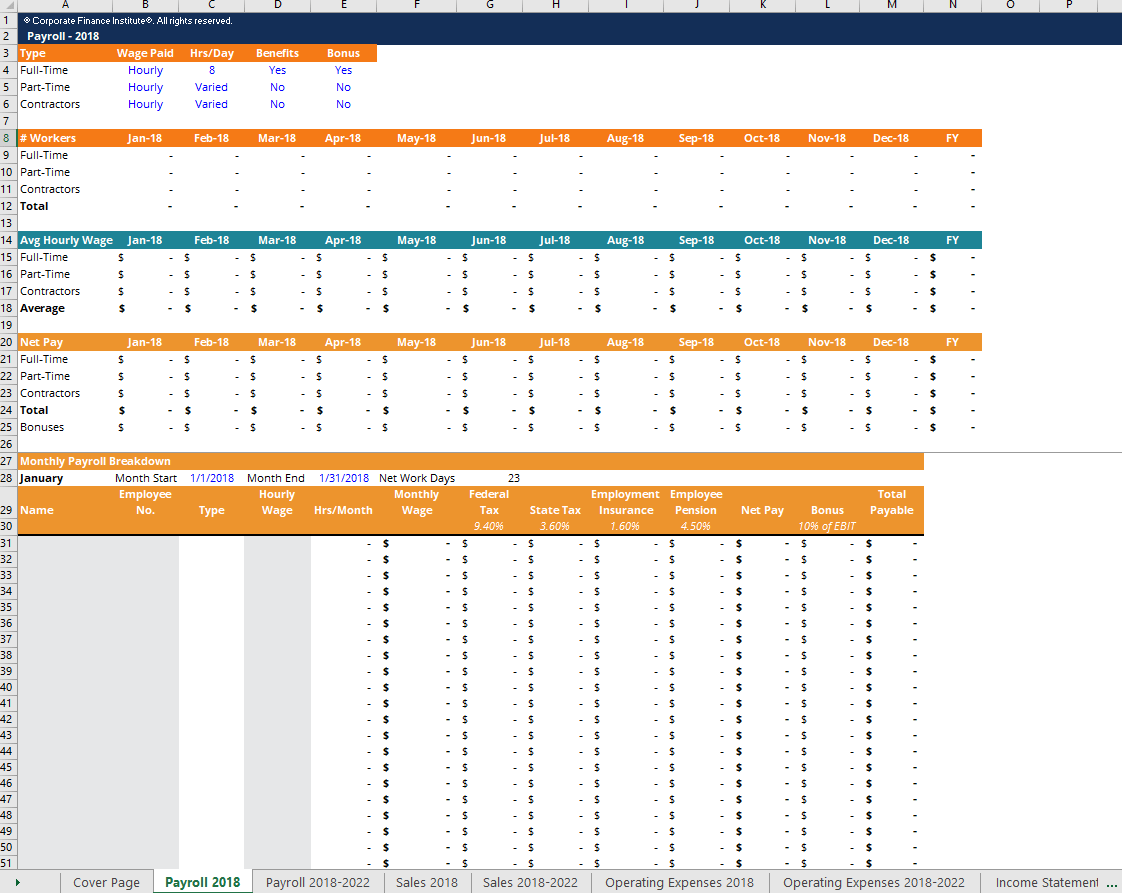

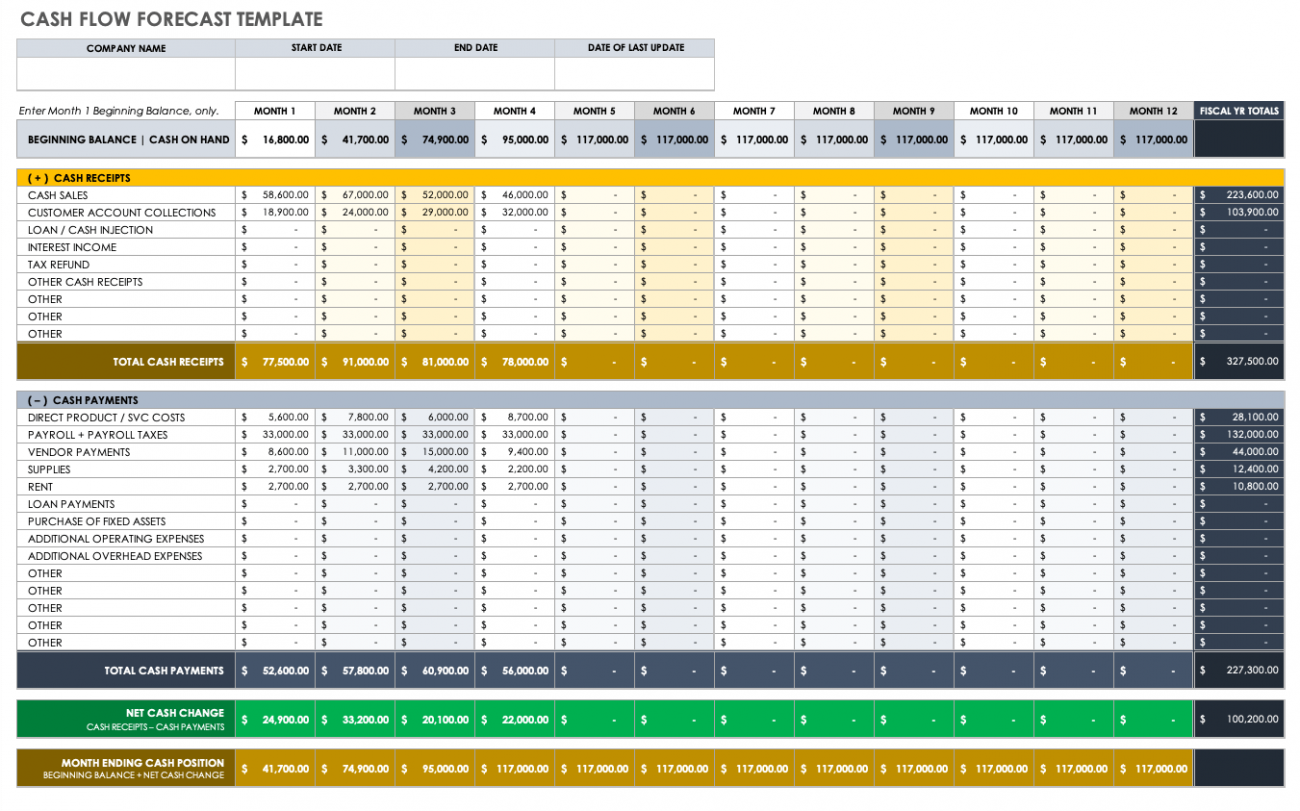

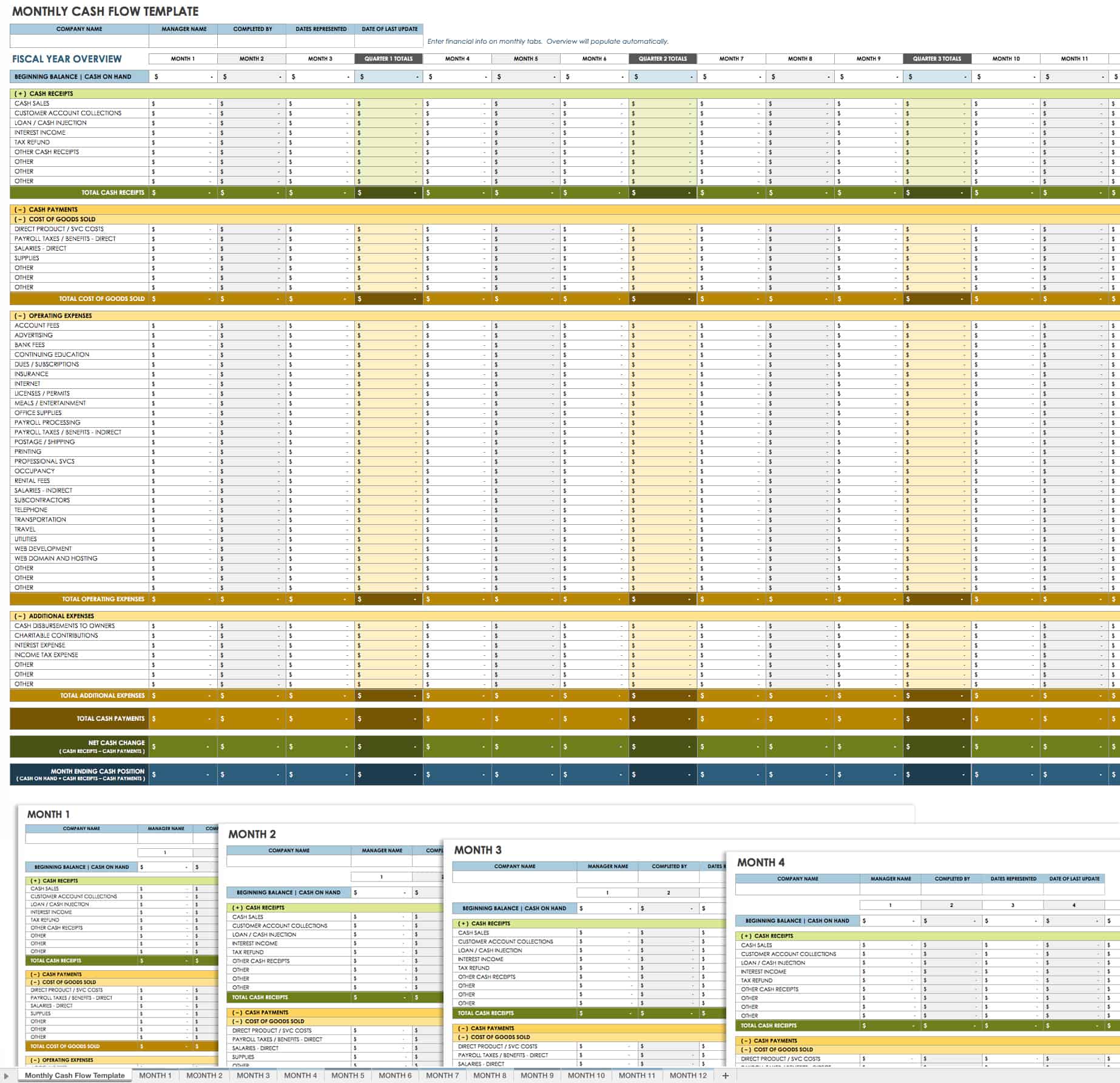

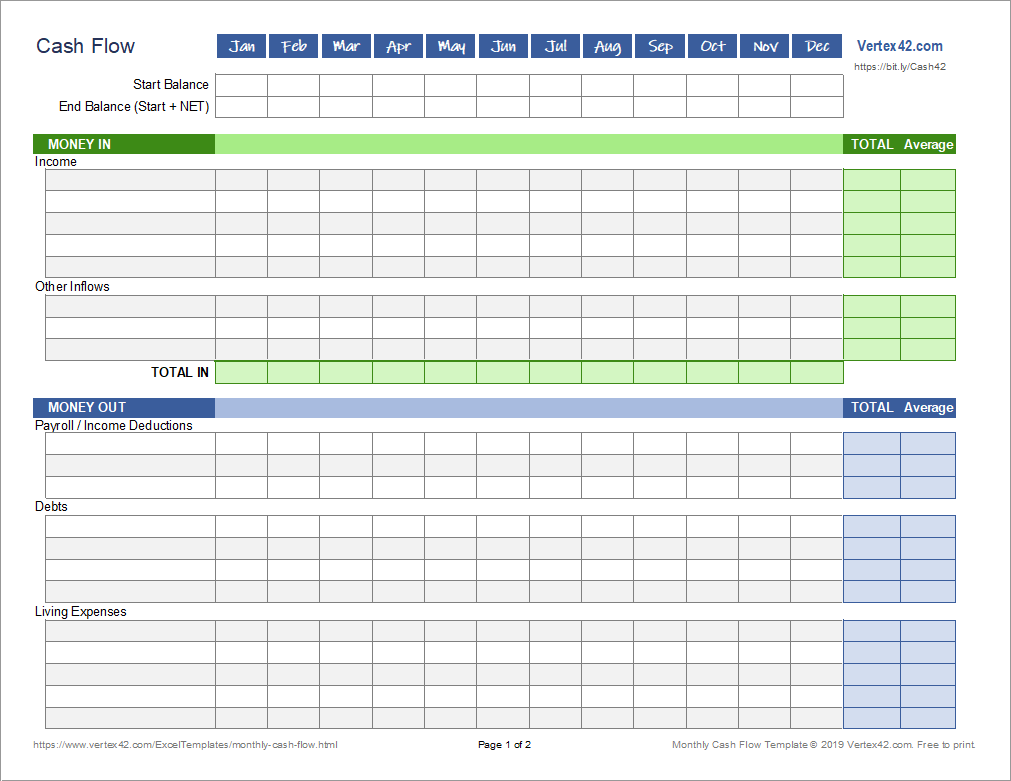

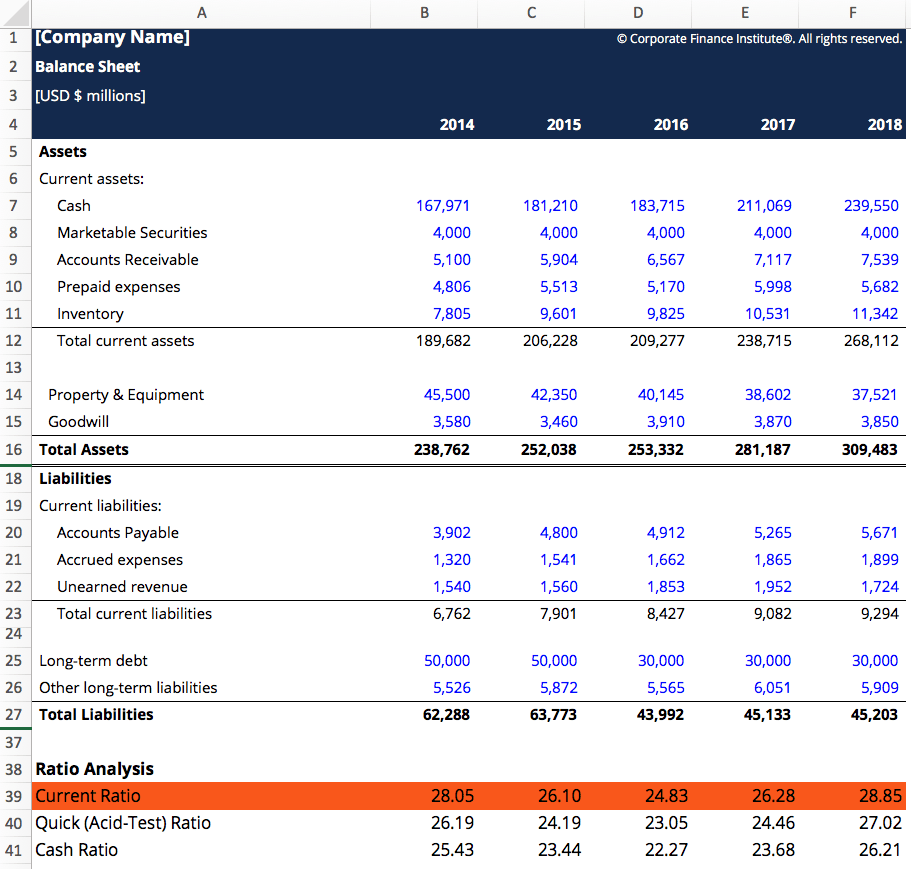

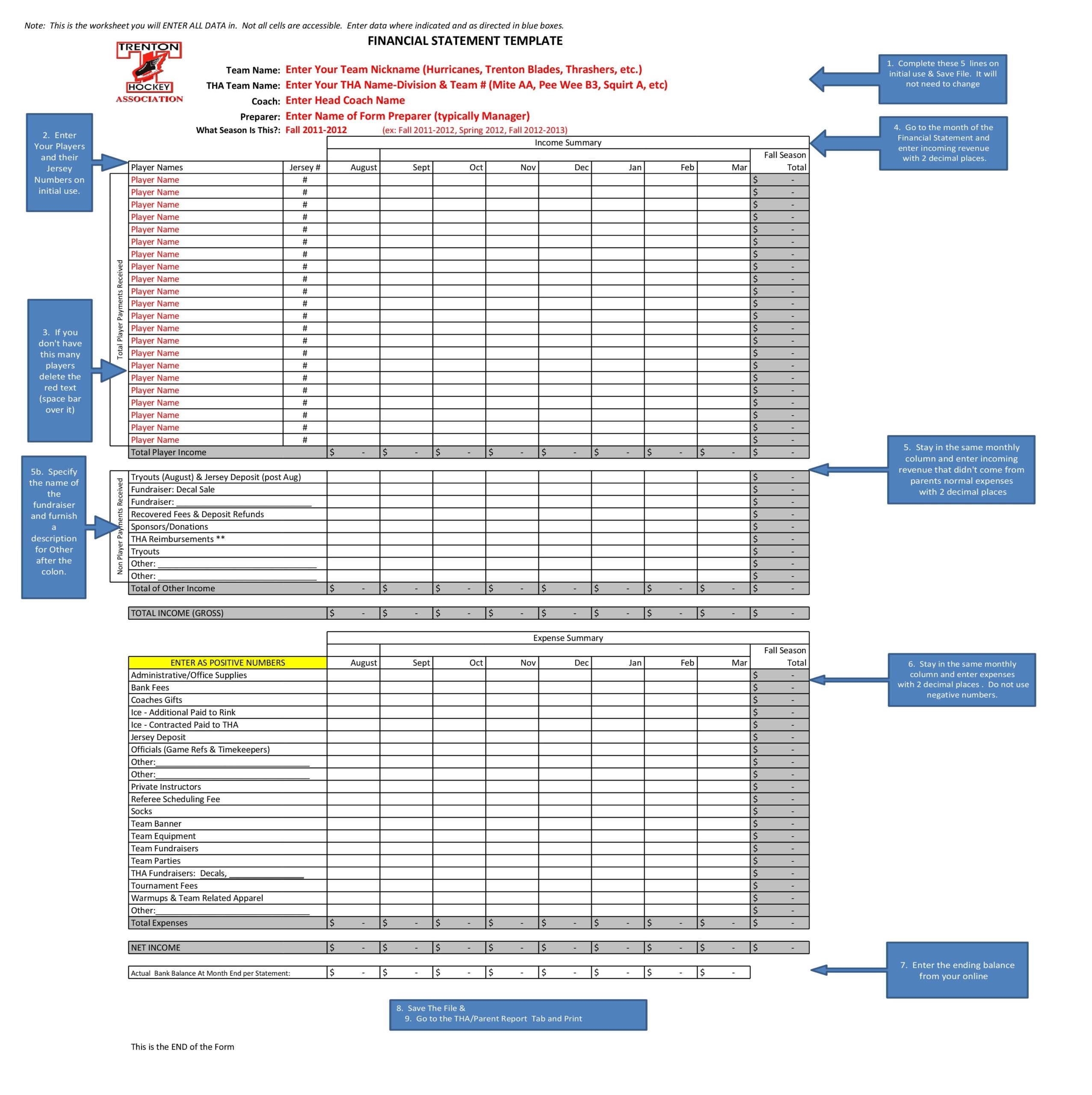

Liquidity Report Template. Allowed to help my blog, on this time I am going to explain to you concerning Liquidity Report Template.

How about graphic preceding? is actually that wonderful???. if you think thus, I’l t provide you with a number of photograph again down below:

So, if you would like secure all these amazing shots regarding Liquidity Report Template, click on save button to save these graphics to your pc. There’re prepared for download, if you appreciate and want to grab it, click save symbol on the article, and it will be immediately down loaded to your computer.} As a final point if you would like receive unique and latest photo related to Liquidity Report Template, please follow us on google plus or save this blog, we try our best to present you regular update with fresh and new shots. We do hope you enjoy staying here. For many up-dates and recent information about Liquidity Report Template pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to give you up-date regularly with fresh and new pictures, like your searching, and find the right for you.

Thanks for visiting our website, contentabove Liquidity Report Template published . Today we’re pleased to announce that we have found an awfullyinteresting nicheto be reviewed, namely Liquidity Report Template Some people trying to find information aboutLiquidity Report Template and definitely one of these is you, is not it?

![11 Week Cash Flow Model in Excel [Template] - Wall Street Prep Pertaining To Liquidity Report Template 11 Week Cash Flow Model in Excel [Template] - Wall Street Prep Pertaining To Liquidity Report Template](https://wsp-blog-images.s3.amazonaws.com/uploads/2020/06/02164951/AHP13WCF.jpg)