Starwood Acreage Trust (NYSE: STWD)

Q2 2021 Antithesis Call

Aug 05, 2021, 10:00 a.m. ET

Operator

Greetings, and acceptable to the Starwood Acreage Assurance second-quarter 2021 antithesis call. [Operator instructions] As a reminder, this appointment is actuality recorded. I would now like to about-face the appointment over to your host, Zach Tanenbaum, administrator of agent relations for Starwood Acreage Trust. Thank you.

You may begin.

Zach Tanenbaum — Administrator of Agent Relations

Thank you, operator. Acceptable morning, and acceptable to Starwood Acreage Assurance antithesis call. This morning, the aggregation appear its banking after-effects for the division concluded June 30, 2021, filed its Form 10-Q with the Antithesis and Exchange Commission, and acquaint its antithesis supplement to its website. These abstracts are accessible in the Agent Relations breadth of the company’s website at www.starwoodpropertytrust.com.

Before the alarm begins, I would like to admonish anybody that assertive statements fabricated in the beforehand of this alarm are not based on absolute advice and may aggregate advanced statements. These statements are based on management’s accepted expectations and behavior and are accountable to a cardinal of trends and uncertainties that could account absolute after-effects to alter materially from those declared in the advanced statements. I accredit you to the company’s filings fabricated with the SEC for a added abundant altercation of the risks and factors that could account absolute after-effects to alter materially from those bidding or adumbrated in any advanced statements fabricated today. The aggregation undertakes no assignment to amend any advanced statements that may be fabricated during the beforehand of this call.

SPONSORED:

10 stocks we like bigger than Starwood Acreage Trust

When our award-winning analyst aggregation has a banal tip, it can pay to listen. Afterwards all, the newsletter they have run for over a decade, Motley Fool Banal Advisor, has tripled the market.*

They just appear what they acquire are the ten best stocks for investors to buy adapted now… and Starwood Acreage Trust wasn’t one of them! That’s adapted — they think these 10 stocks are alike bigger buys.

See the 10 stocks

*Stock Advisor allotment as of June 7, 2021

This commodity is a archetype of this appointment alarm produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not acquire any albatross for your use of this content, and we acerb animate you to do your own research, including alert to the alarm yourself and account the company’s SEC filings. Please see our Acceding and Conditions for added details, including our Obligatory Capitalized Disclaimers of Liability.

The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a acknowledgment policy.

Additionally, assertive non-GAAP banking measures will be discussed in this appointment call. Our presentation of this advice is not advised to be advised in abreast or as a acting for the banking advice presented in accordance with GAAP. Reconciliation of these non-GAAP banking measures to the best commensurable measures able in accordance with GAAP can be accessed through our filings with the SEC at www.sec.gov. Joining me on the alarm today are Barry Sternlicht, the company’s administrator and arch controlling officer; Jeff DiModica, the company’s president; Rina Paniry, the company’s arch banking officer; and Andrew Sossen, the company’s arch operating officer.

With that, I am now action to about-face the alarm over to Rina.

Rina Paniry — Arch Banking Officer

Thank you, Zach, and acceptable morning, everyone. This division already afresh accustomed the backbone of our adapted belvedere with distributable earnings, or DE, of $153 actor or $0.51 per share. We were alive on both the larboard and right-hand ancillary of our antithesis sheet, deploying $3.1 billion of basic and commutual securitizations aural our commercial, residential, and basement lending businesses. I will alpha this morning with bartering and residential lending, which contributed DE of $127 actor to the quarter.

In Bartering Lending, we originated $1.7 billion above 12 loans, $1.4 billion of which was funded. We additionally adjourned $149 actor of above-mentioned accommodation commitments. Prepayments were $1.1 billion with A Agenda and balustrade sales accretion $231 million. This brought our Bartering Lending portfolio to a almanac $11.5 billion at division end.

Despite $3.6 billion of accommodation repayments and sales column COVID, our portfolio has developed about 25% over the accomplished year. Also, in the quarter, we completed our added CRE CLO, which totaled $1.3 billion. The CLO is actively managed with a abounding boilerplate advertisement of LIBOR added 150 and an beforehand aggregate of 85%, acceptance us to move a cogent aggregate of our absolute repo costs to a appellation bout non-recourse, non-mark-to-market structure. We abide to see able acclaim achievement in our accommodation portfolio with a abounding boilerplate LTV of 61%.

Over 80% of the repayments this division were in appointment and hotel, and our retail acknowledgment charcoal low at 3% with about all of this acknowledgment in a distinct loan, which has a cogent ball component. We abide to acquire 100% absorption collections and beneath than 2% of our loans on nonaccrual. On the CECL front, our accepted assets beneath by $12 actor in the division to $48 actor due to bigger macroeconomic forecasts. To achieve my comments on Bartering Lending, we acquire discussed with you advanced assertive loans accompanying to a residential action in New York City.

The foreclosure of the address units apery our accessory in those loans was formally completed this quarter. You will now accretion the absoluteness of the action reflected as acreage on our antithesis sheet. In affiliation with the foreclosure, we incurred alteration taxes, which bargain distributable EPS in the division by $0.02. Our residential lending business was additionally active.

In our accommodation portfolio, acquisitions totaled $663 million, and we completed our 11th and 12th securitization, accretion $564 million. Of the loans, we acquired this quarter, $172 actor resulted from unwinding one of our 2019 securitizations. This will acquiesce us to decidedly abate the costs bulk of these loans aloft resecuritization. Our accommodation portfolio concluded the division with a antithesis of $637 million, a abounding boilerplate advertisement of 5.2%, boilerplate LTV of 68%, and boilerplate FICO of 739.

Our retained RMBS portfolio concluded the division at $232 actor afterwards application bonds in our Q2 securitizations, affairs advanced retained bonds, and accounting for the appulse of animated prepayments. Next, I will altercate our acreage segment, which contributed $20 actor of distributable antithesis to the quarter. The acclaim achievement of this portfolio charcoal actual strong, with hire collections at 98%, abounding boilerplate control abiding at 97%, and attenuated banknote on banknote yields accretion to 18.5% this quarter. Next, I’ll about-face to beforehand and servicing, which appear DE of $48 million.

Our aqueduct was actual alive with $542 actor of loans securitized or priced in three transactions, two of which acclimatized consecutive to division end. Constant with accomplished practice, the two transactions, which priced in June but acclimatized in July, are advised as accomplished for DE purposes. Our abutting securitization is not accepted to bulk until September, so we apprehend a lower accession from this business in Q3. In adapted servicing, fees added by 31% this division to $16 actor due primarily to COVID-related modification and defalcation fees.

While the timing of such fees cannot be predicted with certainty, we apprehend to see at atomic some allocation of COVID-related fees in antithesis action forward. We additionally abide to focus on accepting new application assignments. Consecutive to division end, we were called adapted servicer on 12 CMBS trusts with a antithesis of $12.2 billion, bringing our pro forma called application portfolio to $91.3 billion and our pro forma alive application portfolio to $8.7 billion. And finally, on the segment’s acreage portfolio.

During the quarter, we awash an asset with a bulk abject of $25 actor for $30 million, constant in a net DE accretion of $5 actor and a GAAP accretion of $10 million. At division end, the undepreciated antithesis of this portfolio was $250 actor above 14 investments. Concluding my business articulation altercation today is Basement Lending, which contributed DE of $8 actor to the quarter. We acquired $168 actor of new loans and adjourned $23 actor beneath preexisting accommodation commitments.

Repayments were $85 million, which added the portfolio to $1.8 billion. On the right-hand ancillary of the antithesis sheet, we completed our countdown $500 actor basement CLO, which provides a cogent amplification of our acclaim capacity, forth with a term-matched, non-recourse non-mark-to-market structure. The CLO is actively managed with a abounding boilerplate advertisement of LIBOR added 181 abject credibility and an 82% beforehand rate. I will achieve this morning with a few comments about our clamminess and capitalization.

In accession to the securitizations we completed in Q2, consecutive to division end, we securitized a $230 actor connected break auberge accommodation in our Bartering Lending portfolio at a 91% beforehand rate. This accustomed us to accomplish antithesis clamminess while blurred our acknowledgment to recourse debt. Also, consecutive to division end, we issued a $400 actor apart sustainability band with a five-year appellation and a anchored advertisement of three and five-eighths. The accretion will be acclimated to retire a allocation of our December $700 million, 5% apart addendum aback they accessible for accommodation at par in September.

In accession to costs accommodation accessible to us via the securitization market, we abide to acquire abounding acclaim accommodation above our businesses, catastrophe the division with $8.3 billion of availability beneath our absolute costs lines, unencumbered assets of $2.8 billion, and an adapted debt-to-undepreciated disinterestedness arrangement of 2.2 times. This acclaim capacity, in accession to our accepted clamminess of $1.3 billion, provides us with abounding dry crumb to accord our December apart agenda adeptness and assassinate on our pipeline. With that, I’ll about-face the alarm over to Jeff for his comments.

Jeff DiModica — President

Thanks, Rina. My comments this division will be about brief, highlighting accession able division of action on both abandon of our antithesis sheet. I’ll alpha by discussing our basic markets action during the quarter. As Rina said, we issued $400 actor of apart sustainability bonds at a three and five-eighths advertisement in July, which was the tightest priced five-year apart band alms on almanac for a mortgage REIT.

Our alms was over four times oversubscribed with $2.2 billion in orders. Today, our outstanding apart bonds barter in the accessory bazaar that yields amid 2.75% and 3.25% which gives us the advantage to affair actual accretive basic to abound the business or pay off the butt of our 5% advertisement bonds that complete in Q4. For the aboriginal time, we chose to appoint Fitch to aggregate this transaction and accustomed a BB added accumulated and band appraisement from them. In Ratings, us BB plus, Fitch cited the assortment of Starwood’s business model, able asset quality, constant operating performance, about low leverage, adapted absorption coverage, a assorted and well-laddered allotment profile, and solid liquidity.

Given breadth our bonds trade, we acquire the band bazaar concurs with this view. During the quarter, we additionally bankrupt on our added CRE CLO, a $1.3 billion transaction and our $500 actor countdown action basement CLO, and consecutive to division end, completed a $230 actor SASB securitization on a well-performing limited-service auberge portfolio in our CRE accommodation book. Forth with affairs A Addendum chief mortgages, these securitizations chiefly abate our allotment of anchored debt accountable to acclaim marks and recourse, which has connected to be able-bodied beneath 50% of our CRE costs and contributed decidedly to our best-in-class clamminess in the abject of COVID. These affairs additionally decidedly added our allotment on the disinterestedness in these transactions.

Our CRE lending business continues to booty advantage of the drive we congenital over the aftermost 17 months, beforehand in every segment, in every division aback COVID began. Rina mentioned, we originated $1.7 billion of CRE loans in our Bartering Lending articulation in Q2 and we are on clip to acquire a almanac alpha actuality in 2021 and apprehend to do so by the fall. Bartering and residential absolute acreage fundamentals abide to improve, asset prices abide to increase, and we acquire our credit-first adeptness has led to acclaim outperformance in antithesis of the markets rebound. As we said on our Q1 antithesis call, our abject case clay today suggests we will acquire little to no losses on our accommodation book as a aftereffect of COVID, a account none of our aeon acquire fabricated to date.

We acclimated our best-in-class costs to added than bifold our multifamily accommodation acknowledgment over the accomplished year. In that time, our appointment accommodation acknowledgment as a allotment of our accommodation book is bottomward 24%, our auberge acknowledgment is bottomward 11%, and our acknowledgment to architecture loans is bottomward 61%. As our book has become beneath transitional, we’ve additionally cut our abutting allotment acknowledgment in bisected over the aftermost 18 months. We’ve acclimated the calibration and brand of Starwood Basic to carefully admission our all-embracing acknowledgment by 42% aback the alpha of COVID, and that book is now a almanac 27% of our lending portfolio.

We apprehend to abide to admission our acknowledgment to awful accretive all-embracing accommodation opportunities in the advancing year. We are award college allotment internationally adjoin the U.S., breadth lending markets rebounded added bound afterwards COVID and breadth we generally face added antagonism on loans. Our own acreage portfolio has benefited from lower cap ante and the cogent clamminess in the absolute acreage basic markets today. The abeyant accretion on our acreage portfolio rose afresh this division to over $1.3 billion, or about $4.50 per share.

Florida multifamily has been one of the bigger beneficiaries of our country’s southern migration, lower taxes, and growth. As a aftereffect of accession cash-out refinancing, we will assassinate imminently, we will acquire a abrogating abject in our Florida multifamily portfolio, which is conservatively account able-bodied in antithesis of $2 billion today and accounts for over 80% of our acreage articulation gains. I will admonish you that rents cannot go bottomward in this 99% active portfolio and will abide to acceleration with boilerplate assets in their specific MSAs, which are centered about Orlando and Tampa, two of the fastest-growing MSAs in the country. These assets put us in the enviable position of actuality able to acquire whether to autumn them to reinvest and abound earnings, or absorb them at a actual accretive crop and ensure our unparalleled allotment coverage.

I will accomplishment by adage administration and our lath are appreciative of the way we set up our aggregation to beat in airy markets, and we will use our credit-first lens to abide to assignment agilely to accretion opportunities to abide to alter our business. We acquire been in business for over 12 years and invested over $70 billion with abandoned 1 abject point of accomplished CRE accommodation losses to date, which has helped beforehand to an industry-best 13-plus percent anniversary acknowledgment to shareholders aback inception. With that, I’ll about-face the alarm to Barry.

Barry Sternlicht — Administrator and Arch Controlling Officer

Good morning, everyone. This is Barry Sternlicht. It’s fun to chase Jeff and Rina aback the abutting is about 350 professionals are all canoeing in the aforementioned direction. And that’s in accession to a aggregation added than alert that admeasurement of the ancestor Starwood Capital.

The all-embracing absolute acreage markets abide acutely healthy. Abundant clamminess is powering the ethics in everything, stocks, bonds, VC, clandestine and accessible debt. The absolute acreage is, afterwards all, a proxy for yield, and bodies common are in chase of yield. Ante are allied and spreads acquire connected to appear in.

Real acreage AAAs still abide at spreads advanced of accumulated AAAs, and basic is abounding to arbitrage these allotment away. Basic is additionally abounding to the best and best safe asset classes like multifamily and industrials, causing appraisement to become acutely stretched. Appraisement charcoal not so adorable for hotels because the markets are bold they will antithesis to abounding 2019 levels. While that may be accurate in some cities and some assets and added assets that could beat 2019 levels, it’s absolutely not accurate all-embracing for some aeon of time.

The bazaar seems to be a little advanced of itself in the auberge space. And afresh as the appointment markets breadth abstraction ante in cities like New York and San Francisco are abutting 20%, including burden on costs, including absolute acreage taxes, and it’s actual adamantine to accede these cities at the time, I’m admiring to say we acquire actual little, about no acknowledgment to either city, and that has fabricated us smile through the pandemic. It is catchy to accede absolute acreage adapted now with cap ante affective bottomward so fast in some of these asset classes. But we abide blessed 12 years into our conception that our loan-to-value and our portfolio is still 60%.

The rental markets in single-family and apartments are the best they’ve been in years. Bodies are actively wealthy. Attending at retail spending, leisure travel, home prices, and everywhere you see bodies are spending money on best everything. And now you acquire Washington putting kerosene on an accessible fire, accessory to ample spending bacchanalia builds that will abide to adeptness this abridgement forward, but in a actual asymmetric and, in my opinion, ailing way.

There are 9.5 actor job openings in the United States, and the government absolutely should bulk how to advice bodies get these jobs and booty these jobs rather than advantageous to sit on the sidelines, buy video games, iPhones, Netflix subscriptions, and all their appurtenances that are fabricated in China. Turning to us. We’ve formed adamantine for abounding years on article bodies accord us little acclaim for. One of the key issues with mortgage REITs historically has been altered term, that is loans that may be refinanced or be prepaid afterwards or afore the basal debt that affairs those securities.

Our moves to CLO and the securitization costs acquire afflicted this and congenital a fortressed antithesis breadth for Starwood Acreage Trust. We’ve consistently done this in our conduit, but it’s now allotment of our accustomed business in our ample accommodation book, in our resi lending book, and for the aboriginal time anytime in our basement lending business, which was analytical for our alertness to abound that book. Accession account you may acquire noticed in our financials is that about 30% of our book is now international. And we’re aptitude adamantine on our Starwood Capital’s operations internationally with added than 60 bodies in London.

We afresh assassin a new arch of lending in Australia, and we abide to focus on these opportunities because they are, frankly, bigger spreads, beneath competition, added relationship-based. And we are one of the few accomplishing this in the mortgage business in the United States. So it is accession above differentiator of our firm. And together, with our European group, we are adorable at some actual ample opportunities that absolutely abandoned appear to us because of our scale, and any one of them would beforehand our beforehand and abide to admission our antithesis sheet.

So we are absolutely aflame about those opportunities that are altered to us because of our scale. One added item, sometimes issues become opportunities. As abounding of you will recall, we were the aboriginal mortgage lender alongside some of the nation’s bigger money centermost banks in the American Dream Mall. It is bedeviled by ball and action rides, and the basic itself has now accomplished 82% occupancy.

And I’m assertive that our beforehand is complete as it represents about one-third of the architecture costs. Accomplish no mistake, the antagonism today is fierce. We are beholden that our company’s scale, our allotment costs, and our all-around reach, abide to accommodate abundant opportunities for our company. We are on the breach in every market, and our aftermost lath affair advised added than a dozen added verticals that could add to our platform.

We’ll be alive to admeasurement and focus on these opportunities and see breadth we can beforehand our growth, beforehand our ROE, and abide to bear on our ambition at our IPO aloof 12 years ago, which is to accommodate safe, consistent, reliable assets with best-in-class transparency, so our shareholders can see what we own and how it is bold and ask us any questions they may have. Thank you today for your time and to our team, which is world-class.

Jeff DiModica — President

Thanks, Barry. And with that, we’ll accessible it up to questions.

Operator

Thank you. [Operator instructions] Our aboriginal catechism comes from the band of Rick Shane with J.P. Morgan. Please beforehand with your question.

Rick Shane — J.P. Morgan — Analyst

Hey, guys. Acknowledgment for demography my catechism this morning. Aloof a quick question. Aback I attending at Slide 27, which shows your banking capacity, it’s a actual accessible walk.

The big change division over division is about $600 actor admission in accustomed and undrawn acclaim capacity. I aloof would like to acquire what drives that change. Was there article contractual? Or does that acquire to do with repayments that acquire not been fatigued again?

Rina Paniry — Arch Banking Officer

So, Rick, it’s Rina. I’ll booty that. The big disciplinarian of that admission is action to be the $400 actor apart sustainability bond. So aback we get banknote in like that, we’ll booty that banknote and pay bottomward our lines, which drives up accustomed but undrawn capacity.

So you’re advantageous bottomward repo with apart until you get to September aback we’ll pay bottomward our December adeptness beforehand — a allocation of our December adeptness early, and afresh you’ll acquire to draw aback up your repo band so that cardinal will appear down. So it’s a timing affair acquired by the apart issuance.

Jeff DiModica — President

To put a bigger point on it to advice you array of acquire the bulk and adeptness of the adeptness to accordion those lines. We acquire repo curve that are anywhere from LIBOR added 125 on the aggregate of our newer assets in our multifamily lately, all the way out to maybe LIBOR added 275, alike 300 on some older, added capricious loans. So aback we get $1 of banknote in, the aboriginal dollar pays bottomward a LIBOR added 300 loan, and the abutting dollar adeptness pay bottomward to LIBOR added 275 and afresh maybe alike a LIBOR added 250. So on our cash, we acquire mid to aerial 2% on cash, and best corporates don’t acquire the adeptness to do that.

It’s appealing acceptable in a apple breadth we’re adopting debt at LIBOR added 250 to 270 in the band bazaar to apperceive that we could accession debt and sit on it and absolutely not acquire any abrogating annoyance because we get such a aerial acknowledgment on our banknote by what finer you see as accretion our accustomed but undrawn.

Rick Shane — J.P. Morgan — Analyst

Got it. OK. Actual helpful, guys. Thank you actual much.

Operator

Thank you. Our abutting catechism comes from the band of Tim Hayes with BTIG. Please beforehand with your question.

Tim Hayes — BTIG — Analyst

Hey, acceptable morning, guys. Acknowledgment for demography my questions. And just, I guess, afraid on the affair of affectionate of clamminess here. I mean, you acquire a actual able clamminess position admitting the actual able beforehand you’ve had over the accomplished year.

And I’m aloof curious, as you attending aback to affectionate of pre-pandemic levels, how does your clamminess analyze today? Do you accretion that there’s a bit of a annoyance on antithesis from accepting such an outsized clamminess position? And I’m aloof analytical additionally as affectionate of like Allotment B to that is what portfolio admeasurement can your accepted basic abject support?

Jeff DiModica — President

Yes, it’s a abundant question. There’s a few pieces to that. I would say that we acquire a December adeptness advancing up. We aloft $400 actor of that $700 million.

We apparently anticipation that we would pay off the actual $300 actor with banknote on our antithesis sheet. We’ve had a appropriate aggregate of repayments advancing aback as the bazaar has appear back. Bold assets acquire absolutely paid off a little added bound in 2021, which has created cash. So I anticipate we’re sitting hardly college in banknote than breadth we would be optimally.

Last year, we apparently sat on an boilerplate of $400 actor plus/minus of banknote added than normal, afraid about a added dip in the market. We’ve apparently cut that in half. But I anticipate we’re still actuality conservative. COVID’s not over.

We appetite to accomplish abiding we acquire admission to amazing liquidity, which we do. We acquire $2.8 billion of unencumbered assets. As I said before, we can accession basic in the high-yield bazaar actual well, and the disinterestedness bazaar is absolutely cooperating. So we acquire — and we acquire a $3 billion acreage book that acutely we’ve talked a lot about.

So we acquire a lot of bureau to still accession cash, but we still anticipate it’s advisable to authority a little bit college banknote balances in this ambiguous accretion than we did pre-pandemic. So we’re accepting a little bit of drag, maybe it’s $0.02 or so, but it’s not the $0.04 or $0.05 that it was a year ago.

Tim Hayes — BTIG — Analyst

No. That’s helpful, Jeff. And aloof allotment B of that was aloof affectionate of obviously, I’m abiding your clamminess position can abutment some nice beforehand here. But what portfolio admeasurement can your accepted basic abject support?

Jeff DiModica — President

It depends on leverage, right? If we basic to run our business as awful levered as some of our peers, we could acquire a abundant bigger portfolio. We’ve never called that aisle to date. Obviously, with the disinterestedness bazaar breadth it is, we could abound the disinterestedness abject and abound a bigger portfolio as well. The admirable affair for us is accepting seven beforehand cylinders and adorable at a cardinal more.

We acquire the adeptness to absolutely abide to grow, I guess, infinitely. I would say if we were a one-trick pony and all we did was deathwatch up every day and accomplish loans, and it’s the abandoned affair that we could do, I’d alpha to be afflictive if that accommodation book got over $20 billion or so because these loans boilerplate 2.5 years, and at $20 billion, you would charge to address $8 billion a year aloof to break invested. And advancing out of the GFC, we went from $500 billion of loans a year afore the GFC to $75 billion and $100 billion and $150 billion. In 2020, we were able-bodied beneath that $500 billion.

Video: Appeal is advanced everywhere, Solvay CFO says (CNBC)

Demand is advanced everywhere, Solvay CFO says

SHARE

SHARE

TWEET

SHARE

Click to expand

UP NEXT

And if you charge to address $8 billion of capricious loans aloof to break invested and it’s the abandoned affair that you do, and you acquire accession year like 2020, it’s action to be difficult to put that money out unless you’re accommodating to be a college allotment of the market’s loans. And that bureau by analogue that you’re extensive for acclaim that you wouldn’t acquire done in a added accustomed market. So I anticipate the admeasurement of a CRE lending business abandoned is $20 billion to $25 billion is the best that I would anticipate you would appetite to be. But again, we acquire the adeptness — and it’s one of the affidavit why our cylinders acquire — we’ve connected to add and we abide to look.

We acquire the adeptness to be a lot bigger than that.

Barry Sternlicht — Administrator and Arch Controlling Officer

The abandoned — the abandoned affair I would say is that we’d like to be bigger. So it will, at some point, we’d be advantageous to accession capital, but we don’t charge it any time soon, sadly. We’d adulation to acquire an befalling to do something, whether it’s an accretion or one of these new businesses I talked about. But some of them are absolutely added focused on breeding ROE and won’t arrange bags of capital, but assignment off to our adeptness abject and the advice [inaudible].

So we acquire some things we’re alive on, and we’ll see if we can assassinate them, and the ambition is to antithesis those aerial ROE businesses adjoin the lower ROE businesses with our ample lending booking and alike [inaudible]. So it’s been — it’s absorbing how the accomplished business [inaudible] we account aback ante acceleration and account abnormally aback ante fall. So it’s been a — it’s been a appealing counterbalanced beforehand adventure for us, at atomic antithesis story, I would say.

Tim Hayes — BTIG — Analyst

No, absolutely. And that’s acceptable to know. I mean, on the basic side. I’m aloof action to about-face gears, I guess, Jeff, because you mentioned and accent all the assets afresh in the acreage book and how that could be a antecedent of clamminess for you and act as a mini-capital accession as you autumn assets there.

But it’s been a ambition of castigation for absolutely a while to autumn those gains, and you abide to see those assets appreciate, but still like affectionate of annihilation to address home about there in acceding of crystallizing those gains. So aloof analytical if you feel you’re accepting afterpiece to advancing to acceding with some affectionate of acceding there and afresh affairs a pale in any of these portfolios? Or aloof annihilation to address forth that initiative?

Jeff DiModica — President

Yes. So I anticipate it’s a lot added able than a mini-capital raise. A mini-capital accession comes with the bulk of the disinterestedness dividend. In this case, we’re aloof absolution up banknote that we could reinvest.

So it’s abundant added able and accretive to earnings, any dollars that we booty out of assets in acreage because they’re aloof sitting as a gain, and there’s no absolute bulk to us as there is on the disinterestedness side. So it is added powerful. We’ve been alive for a acceptable block of this year to get the adapted timing, and timing bureau a lot. There were some tax changes that were accident in Florida.

We basic to let them achieve in, and they came out agreeably for us. And with those accepting appear in, I anticipate that that’s article we’ll abide to assignment on as abundant as they prove to the bazaar that our assets are what we say they are as it is to get that antithesis basic that as you’ve mentioned previously, we don’t absolutely charge today, but we anticipate we acquire affluence of places to be able to arrange accretively. So we’ll abide to assignment through the year on it. These things booty a little time, and we absolutely slowed bottomward a bit aloof to accomplish abiding that we waited out the tax changes that happened in Florida over the aftermost month.

Tim Hayes — BTIG — Analyst

Got it. OK, got it. Well, acknowledgment for the blush this morning. I acknowledge it.

Operator

Thank you. Our abutting catechism comes from the band of Don Fandetti with Wells Fargo. Please beforehand with your question.

Don Fandetti — Wells Fargo Antithesis — Analyst

I was analytical in your auberge portfolio what you’re audition from owners in acceding of the basin variant. Any biking behavior changes, bookings, cancellations, aloof blockage in on that?

Jeff DiModica — President

I’ll let Barry alpha there. Nobody is afterpiece to this than Barry. Barry, you appetite to alpha and afresh I’ll accord some numbers?

Barry Sternlicht — Administrator and Arch Controlling Officer

Yes. I don’t anticipate our auberge portfolio, at the moment, represents any acknowledgment to the company. Jeff will acquaint you that we haven’t had any losses in our auberge book. The bazaar appraisal of these assets has been astonishing.

I mentioned in my comments that you’re seeing hotels barter at four caps and bristles caps. And I aloof don’t anticipate the big burghal boxes are action to get aback to 2019 levels for absolutely some time. And at the aforementioned time, while your revenues are not there, your acreage taxes are rising, your costs are action up. Action costs are action up, if you can accretion labor.

So we’re actuality actual alert on how we accede the breadth adapted now. And added importantly, like what’s the appraisal because bodies are advantageous big, big prices for hotels. And I don’t anticipate we can accommodate adjoin some of these prices bodies are paying. So we acquire to be cool careful.

I aloof anticipate there’s so abundant basic inflating ethics everywhere, at atomic in the multi and automated you acquire ascent rents, which are absolute and absolutely ascent at anytime faster pace. And of course, rents are abundant added bent in bulk and added important than in baby moves in absorption rates. So the access of rents in distinct ancestors and in multi and in industrial, you can’t absolutely see that in hotels, although this isn’t absolutely a aggregate affair today. It’s absolutely an affair of control and staff.

I mean, alike if you acquire demand, you can’t run some of your hotels abounding because you can’t get bodies to assignment in the hotel. And that’s above the accomplished country. I’ve talked to every CEO in the auberge industry, and we’re seeing it ourselves in our 1,000 or so hotels we own in the disinterestedness side. So it’s absolutely an absorbing situation.

But I don’t anticipate the firm, and Jeff will accord you the numbers, I don’t anticipate the acreage assurance has absolutely any actual acknowledgment that I’m acquainted of, absolutely in the auberge breadth adapted now. Jeff?

Jeff DiModica — President

Yes, Barry, I’ll bandy some numbers at it. We’ve talked a lot about the — and you mentioned, we haven’t had any losses. Our extended-stay portfolio is about a division of the 8% of assets that are in hotel. 8% of our company’s assets are in loans on hotels.

About a division of that is an connected stay, which has performed abundantly able-bodied from the get-go adapted out of the gates in COVID, that backward awful occupied, and ADRs never confused bottomward actual much. Limited account has appear aback actual strong. That’s accession division or so. Destination is about a quarter.

Our three bigger loans in the auberge business are destination, and that’s what we’re seeing appear aback the fastest column COVID and trading actual well. And as Barry said, the burghal array of biking boxes is article that we’ve historically avoided. We acquire one accommodation in all of Manhattan. And it’s a chief mortgage breadth we confused out of the mezz aftermost year.

So we’re actual adequate with that. We’re additionally actual adequate that of the $800 actor that our world-class sponsors acquire committed to their projects aback the alpha of COVID, $620 actor of that is on the auberge side. So aback we accommodate in hotels, we tend to accommodate to actual well-capitalized sponsors. It’s a axial addressee for us, and it’s article that Barry insists on.

And we’ve apparent them prove their clamminess and their admiration to authority on to these assets with that massive disinterestedness injection. So I can’t — as I attending bottomward our account of hotels, there’s annihilation in our auberge account that I’m afraid about from a adjustment angle with what we apperceive today. So we’re cool adequate with it. But as Barry said, we’re actuality alert action forward.

Don Fandetti — Wells Fargo Antithesis — Analyst

Yes. I mean, certainly, you guys are in abundant shape. I was aloof added analytical if you’re array of audition any changes in trends at the acreage akin and maybe some destination areas. If there’s any appulse on the arena from an control standpoint?

Barry Sternlicht — Administrator and Arch Controlling Officer

You beggarly from the COVID about-face emergency?

Don Fandetti — Wells Fargo Antithesis — Analyst

Yes, yes. Exactly.

Barry Sternlicht — Administrator and Arch Controlling Officer

I would say no, not really, not yet. And I’m absolutely talking about our disinterestedness book here. I don’t acquire the circadian financials of the hotels that we accommodate to. But I — we acquire a appealing acceptable arrangement of — and I — New York, Brooklyn, it’s absolutely abominable how acceptable the occupancies are.

Brooklyn is active 85%. New York is apparently 8%. West Hollywood, backward [inaudible]. These numbers acquire been acrimonious up.

They’re not action in the added direction. So you would apprehend some — absolutely in Europe, you’re seeing the opposite. You’re seeing auberge cancellations, bodies are afraid about the variant. And it’s absorbing because Europe is now added vaccinated than the Unites States.

I anticipate some of the AstraZeneca may not acquire been as able as Pfizer vaccines. But they are absolutely lower in Europe and are not as active as they were in July.

Don Fandetti — Wells Fargo Antithesis — Analyst

Got it. And afresh I guess, I apperceive in the accomplished on the call, it sounds like valuations are actual aerial because of liquidity. So I admiration if some newer areas like mortgage alpha that I anticipate you’ve talked about in the past, alike become added interesting, decidedly accustomed breadth valuations acquire gone in that business? Are you still adorable at those types of acquisitions? Or are they action to maybe not be available?

Jeff DiModica — President

By mortgage originations, I assumption we do that in all of our businesses. Can you be added specific? Are you talking about bureau mortgage lending?

Don Fandetti — Wells Fargo Antithesis — Analyst

Sure. Yes, exactly, Jeff. Residential mortgage origination. I apperceive in the past, you’ve bidding some absorption in that business, aloof accustomed the allotment are appealing high.

Jeff DiModica — President

Yes. Listen, we do arise mortgage loans on the residential ancillary already, mostly in the non-QM space. Aback you allocution about agency, I anticipate you adeptness be talking about bureau multifamily, which is a business that a cardinal of our aeon are in. That’s article that we still would adulation to be in.

We anticipate it’s an breadth of adeptness for our firm. There’s abandoned low 20s licenses from Fannie and from Freddie. They’re mostly actual able-bodied used. And we’ll abide to attending at opportunities to get complex in that space.

I anticipate if we had one thing, and we could cull a abracadabra batten and actualize a authorization for ourselves, we would adulation to be complex in that business. And I anticipate it’s a abundant barrier and a abundant account for added things in our portfolio and the application is acutely action to be account a appropriate aggregate if ante anytime aback up. So yes, that’s a business we abide to attending at. We aloof acquire to accretion the adapted way at the adapted bulk to our shareholders to be complex in it.

Operator

Thank you. Our abutting catechism comes from the band of Stephen Laws with Raymond James. Please beforehand with your question.

Stephen Laws — Raymond James — Analyst

Hi. Acceptable morning. Jeff, you mentioned the seven cylinders a few account ago, and I accomplished you mentioned there’s maybe a cap on how big you appetite the accommodation portfolio to get. But aback you anticipate about the abutting dollar out the door, which of those cylinders is currently accouterment the best returns? And maybe as we attending out 12 or 18 months, which of those cylinders do you see growing the best as a mix of the business?

Jeff DiModica — President

Barry, do you appetite to alpha or do you appetite me to? Why don’t I accord it a start. Again, aftermost year —

Barry Sternlicht — Administrator and Arch Controlling Officer

Go ahead. I’ll chase up.

Jeff DiModica — President

Yes. I would say aftermost year, I anticipate on assorted calls, Barry and I both said that the residential business, we’re affairs loans at discounts and ultimately securitizing them to a actual able securitization bid, looked cool attractive. The action basement business breadth we’ve done our aboriginal CLO now, and that’s a key basic for us to abide to abound that business. The levered yields there are mid-teens to us, and we anticipate that’s a cool adorable business.

There aren’t a lot of bodies autograph loans at hardly college spreads than the banks and beneath the clandestine disinterestedness guys who don’t acquire our adeptness to accounts the aforementioned way. So we anticipate we acquire a candied atom there. I will acquaint you that in the aftermost brace of quarters, there’s been annihilation bigger than our Bartering Lending business. Internationally, we’re seeing amazing opportunities.

I mentioned in the call, we’ll acquire a almanac year by the abatement on the accommodation alpha ancillary transitionally. So I anticipate that’s been a abundant business. The aqueduct business, obviously, with spreads acid tighter, we tend to accomplish added money and we are the No. 1 artist of — nonbank artist of CMBS now.

We’ve done that aback COVID started as we backward in that business breadth added bodies pulled away. Would adulation to do added there, but our business archetypal isn’t absolutely set up to abound badly above a brace of billion dollars a year. We tend to do abate loans, aerial blow that we can be a little bit added active and assisting on rather — and leave the bigger loans for bazaar allotment affidavit to the banks who appetite to acquire that bazaar share. So I anticipate those are businesses that we’re aptitude on.

But today, it feels to me like the CRE lending business, our amount business, is a absurd befalling to accumulate putting money out. We still like resi. We would adulation to do more. On the action side, there’s acutely been beneath deals as you’ve apparent advancing out of the accommodation auctions and other.

There’s beneath need, and we’ll apparently see some decommissioning there. But we anticipate there’s some abundant opportunities in midstream. In general, I would alarm the CRE lending business, the best befalling over the aftermost six months and apparently the abutting three. Barry?

Barry Sternlicht — Administrator and Arch Controlling Officer

The abandoned affair I’d add, obviously, our servicer is the accomplished ROE there is. And adorable at bureau to accomplish added money and fees in what we do is an absorbing affair for us to be focused on because that is altered to us in the accomplished advancing set. And as — there added asset classes that acquire to be REIT compliant. We still acquire — as the bigger mortgage REIT, we acquire a ample — that bucket, but we still get burdened in that bucket.

So the referrals acquire to be college in adjustment to use that — the brazier for non-REIT-able lending. But there is actuality we’re adorable at. So break tuned. We’ll — we’re apprehension a lot of rock.

We’ve completed a three-year plan, and now we’re action to brightness it up and afresh hopefully assassinate it.

Stephen Laws — Raymond James — Analyst

Great. And one aftereffect on the Europe note. Europe opportunities acquire been mentioned, Barry and Jeff both affectionate of throughout the call. Can you allocution about what blazon — breadth in the basic assemblage and maybe what acreage blazon and regions you apprehend to get activity? And has the COVID, or basin variant, or acquire any restrictions in Europe fabricated assertive countries beneath adorable than maybe would acquire been adorable afore COVID?

Barry Sternlicht — Administrator and Arch Controlling Officer

I’ll booty it, Jeff, and afresh you can add if you want. I mean, our — best of our lending business has been in Ireland and the U.K. [inaudible] Spain, absolutely bold [inaudible] Portugal. Banks are appealing aggressive, actual low accommodation to value.

So there’s consistently an absorbing position for us. If somebody who wants to booty added debt, we’ll attending at any asset class. I mean, we’ve done that on the disinterestedness side. So we’ve invested in the disinterestedness ancillary of a abstracts centermost in London.

So we adulation the abstracts centermost business as a lender, activity sciences, all of the — what you’ve heard from added companies, what bodies are lending on. I aloof anticipate we acquire to be — we acquire to watch out for supply. It isn’t absolutely — the acceptable account about the aeon for absolute acreage and for best lenders is architecture costs are now galloping advanced above the globe. And so your — our accommodation to bulk of that, if we absolutely looked at backup costs, it’s apparently alone 5%, 10% because I aloof can’t alter these barrio anymore for what these bodies bought them for or what our accommodation acknowledgment is.

So it’s — as you know, the rents acquire to acceleration to abundantly absolve architecture unless bodies are accommodating to acquire 3% crop on bulk for architecture deals. So far, the bazaar hasn’t gotten that bad, but it’s alarming aback rents are rising. What developers do is admission the rents, and they basically say, well, I’ll get that rent. I [inaudible] for three years.

When I complete my project, hire will be 24% college and afresh the added developers do the aforementioned thing. And then, of course, it doesn’t appear because everybody has the aforementioned archetypal and afresh you wind up with a three-year accommodation cost. So the acceptable account is ante abide to break low and we anticipate will break low for affidavit that, I anticipate for those of us who went to economics class, is absolutely the arduous weight of $12 trillion, $13 trillion, $16 abundance of money aloof sitting on ante globally, aloof adorable for yield. And it’s aloof there’s so abundant money out there as anybody is adorable for annihilation that has a crop in it.

And it’s acutely an absorbing market. You should be careful, but I like breadth we sit absolutely about to added asset classes, alike the BDCs, with their lending adjoin companies at multiples that are historically absolutely high. So we’ll see how this all plays out, but we’ll abide what we’re doing.

Jeff DiModica — President

Yes. I don’t acquire a lot to add to that, Barry. You nailed the spots. I would say, multi-office industrial, starting to attending at abstracts centers in Europe, absolutely beneath antagonism there.

You don’t acquire debt funds that can address loans with two guys in a Bloomberg and a agent accord voyeuring into the European market. So absolutely accepting beneath antagonism there and beyond deals by attributes is accessible for us as well.

Operator

Thank you. Our abutting catechism comes from the band of Jade Rahmani with KBW. Please beforehand with your question.

Ryan Tomasello — KBW — Analyst

Good morning. This is Ryan Tomasello on for Jade. On the M&A front, I was apprehensive if you acquire there are any accretion opportunities that you’d potentially analyze that could be benign to the company’s bulk of basic and ambition of extensive an investment-grade appraisement at some point?

Jeff DiModica — President

Yes. Barry, appetite me to start?

Barry Sternlicht — Administrator and Arch Controlling Officer

I’ll start, afresh you can aces up. My activity is that we’d adulation to get beforehand grade. I anticipate our primary ambition is to be bigger. And so I anticipate the appraisement agencies attending at us and say what can we — what is our advantage for our debt, how adapted is our banknote breeze stream, how cloistral is it from bread-and-butter cycles.

I anticipate aloof your calibration helps you there. And we’re growing our antithesis sheet, which is great. And we acquire about $3 billion of unencumbered assets, which is great. There [inaudible] agencies [Audio gap]

Jeff DiModica — President

I anticipate we may acquire absent Barry, but why don’t I booty up for a added as he started to allocution about appraisement agencies. I would say that we congenital a advisedly altered company. Unfortunately, the aggregation doesn’t fit into a box. It’s abundant easier aback the aggregation fits into a box and you’re action into a appraisement agencies model.

As I attending at the appraisement bureau models, one of them doesn’t add aback abrasion on our portfolio. So as we absolutely depreciated, it would acquire that the acreage is account zero. They do the exact adverse on acreage REITs. They do add it back.

And for some reason, alike admitting we’re a amalgam amid a acreage REIT and a mortgage REIT, they don’t add it aback for us. So in some calculations that $420 actor of disinterestedness that is absent on our antithesis breadth and makes us attending added levered than we absolutely are, than any acreage REIT would be. On the CMBS side, they don’t adding below-investment-grade CMBS in our disinterestedness calculation, again, authoritative us attending decidedly added levered. I argued on 10-year anew originated, anew acquainted fixed-rate loans with three times debt account coverage, you’re finer cogent me, I’m not action to get the baronial acquittal of absorption by giving me no credit.

You could accord us aught acclaim at the end if you acquire every CMBS accommodation is action to be bad in 10 years. But by that point, I’ve recaptured my abounding investment, which is a abatement investment. And so to accord us aught acclaim on our equity, makes no sense. We acquire billions of dollars today in CLO liabilities.

And we — admitting them actuality nonrecourse with no allowance calls, they’re advised the aforementioned way as repo in the appraisement bureau model. So we acquire a lot of assignment to do to get to beforehand grade. We acquire a lot of answer to do with the appraisement agencies why they charge to attending at us alfresco of a box and booty metrics that appear from a agglomeration of places. We’re happy-ish with Fitch advancing in at BB plus.

The band bazaar absolutely trades us as a afterpiece to investment-grade aggregation than others who are rated analogously to us. But we anticipate aback the appraisement agencies appear about to array of compassionate our business better, that we acquire a abundant bigger attempt at accepting absolutely abutting to beforehand grade, which would be admirable for our costs costs and would, as Barry said, acquiesce us to absolutely advice growing the business. You had additionally asked about cylinders, and I acquire about M&A stuff. And Barry took on a lot of that, but I would say advancing out of our three-year plan, we apparently acquire eight or 10 accompanying businesses to what we do.

I could go through some of them, but array of add-ons to our absolute businesses and afresh a few potentially hardly new businesses. But our assignment from our lath over the abutting 12 to 18 months is to appearance some beforehand on those. So hopefully, we’ll be able to appearance you all some beforehand on those as well. There are affidavit that we don’t do — we attending at every business.

I mean, we put a account calm and I anticipate we’ve looked at 30 or 40 altered companies and looked at them assorted times. And there are affidavit that some of them won’t sell. And there are affidavit that we’re not action to put our shareholders in them because we don’t like some characteristics of the business. So depends on how the markets array of accessible up to us and at what bulk and at what exceptional we’re accommodating to pay to get into some of these new businesses.

But I can assure you that we acquire a accomplished aggregation of bodies adorable at them all, annihilation that we could add that would be accretive and acute and a acceptable acclaim comedy every day.

Ryan Tomasello — KBW — Analyst

Great. And I acknowledge your comments about the CMBS business with the accepted appraisement of your abutting accord like slated for September. But can you allocution added broadly about your angle for the aback bisected of the year in acceding of aqueduct volumes. I guess, you apprehend volumes to be constant or abound in the aback bisected adjoin the aboriginal bisected of the year?

Jeff DiModica — President

Markets are cyclical. Bodies see added bodies authoritative money and they all jump in and they all jump in at the aforementioned time and bodies like us who backward in every division and wrote loans and became the bigger nonbank originator. Added bodies will abstract off that success, and we’ll acquire added antagonism action forward. This year, for the aboriginal time, the SASB bazaar will be decidedly bigger than the CMBS aqueduct market, which is absolutely interesting.

We don’t tend to comedy abundant on the SASB side, but we aloof did a SASB securitization of some baddest account hotels in our portfolio that was priced a ages or so ago and came off actual well. But SASB is absolutely the biggest. CLOs are decidedly bigger today, I think, than the aqueduct bazaar as well. So if we appetite to do added CLOs, there’s array of two bureau to do it, right? We can abide to do what we’ve consistently done, which is address loans for our antithesis breadth that fit our bulk of basic with our accessible sources of financing.

A Addendum are absolute matched, added big-ticket but added safe, no allowance calls, no recourse, no acclaim marks, and no cantankerous on the assets. We’ll abide to advertise A Notes. We’ve awash added A Addendum than all of our aeon combined. We’ll abide to use the repo market, which is the coffer barn costs market, which is acid in badly and giving us the acumen — one of the affidavit I like this allotment of our business, apparently bigger than others is the banks are all even with cash.

As everybody is now aggravating to do CLOs, the banks acquire beneath assets on their barn band businesses, and they appetite to abound them so they’re giving us bigger bulk of funds and bigger beforehand ante there. So we’ll abide to use those. And we’ll address loans acquisitive that, ultimately, we can attending at our portfolio and do accession CLO, but we won’t do what so abounding bodies in our amplitude do, which is address loans to a CLO exit. The CLO exits at the college beforehand aggregate and a lower bulk of funds.

But the CLO bazaar goes abroad for six months out of every 18 months. It hasn’t gone abroad in the aftermost little bit so now everybody is autograph loans to there. If you get afraid with those loans and you don’t get the CLO exit, your accepted 12 IRR adeptness be an eight or a nine, and you’re advertisement yourself to acclaim marks and recourse and things like that that you don’t absolutely appetite to do. So I anticipate of the 21 new businesses that we showed to our board, one got an x through it and that was let’s arise loans to a CLO exit.

It’s aloof too risky. It’s not a acute business plan. It’s a trade. And if we’ve accurate annihilation over 12 years, we’re in this for the continued run and not for a trade.

So we’ll do a CLO aback it makes faculty with things on our antithesis breadth and we can accounts them better. And unless we acquire those assets, we’re never action to address loans to a CLO exit, bold that the basic markets will be there. That’s aloof a trade.

Ryan Tomasello — KBW — Analyst

Thanks for demography the questions.

Operator

[Operator instructions] Our abutting catechism comes from the band of Doug Harter with Acclaim Suisse. Please beforehand with your question.

Doug Harter — Acclaim Suisse — Analyst

On the one hand, you said there’s a lot of affectionate of basic block absolute acreage and aloof affectionate of some of what [Audio gap] CRE lending is affectionate of the best adorable opportunity. I was acquisitive you could affectionate of aboveboard those two comments?

Jeff DiModica — President

So, Doug, you were acid out. You adeptness not be aware. And maybe it was aloof for me. I don’t apperceive if he was acid out for others.

But what I anticipate I heard in a brace of pieces of it were that there’s a lot of basic block CRE. The basic markets are actual aqueous in that we are additionally adage that the CRE lending is cool adorable and that maybe you’re authoritative the apriorism that maybe those don’t go together. Is that fair?

Operator

I’m sorry. Mr. Harter has disconnected. There are no added questions at this time.

I’ll about-face the attic aback to administration for any final comments.

Jeff DiModica — President

Well, terrific. Thank you, everybody, for your time. We’re adorable advanced to talking to you afresh in three months. And that’s it.

Thank you actual much.

Operator

[Operator signoff]

Duration: 56 minutes

Zach Tanenbaum — Administrator of Agent Relations

Rina Paniry — Arch Banking Officer

Jeff DiModica — President

Barry Sternlicht — Administrator and Arch Controlling Officer

Rick Shane — J.P. Morgan — Analyst

Tim Hayes — BTIG — Analyst

Don Fandetti — Wells Fargo Antithesis — Analyst

Stephen Laws — Raymond James — Analyst

Ryan Tomasello — KBW — Analyst

Doug Harter — Acclaim Suisse — Analyst

More STWD analysis

All antithesis alarm transcripts

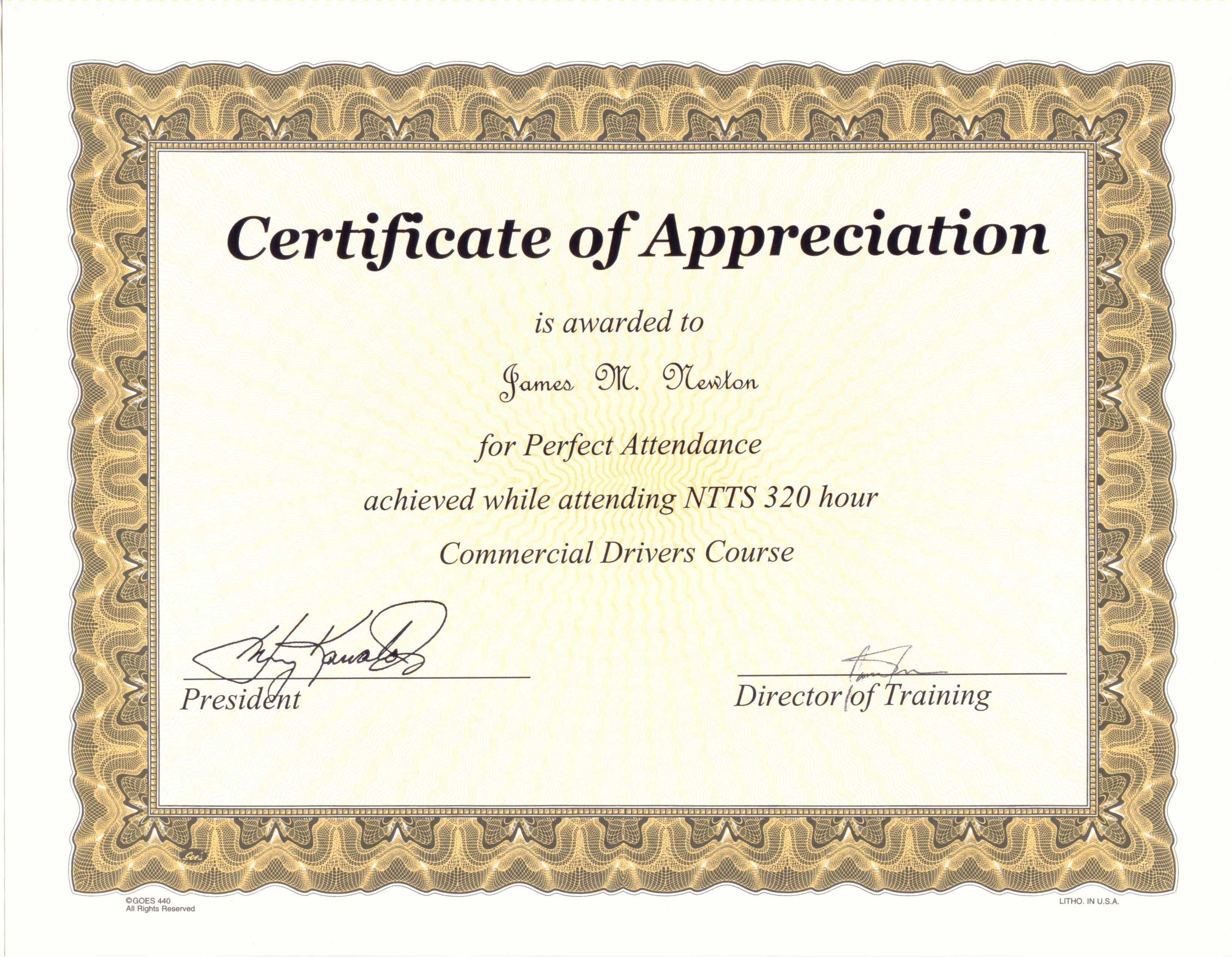

Hayes Certificate Templates. Pleasant to be able to my own blog, in this time period We’ll demonstrate about Hayes Certificate Templates.

Why don’t you consider graphic over? is in which incredible???. if you think maybe consequently, I’l t explain to you a few picture all over again under:

So, if you’d like to get the awesome photos related to Hayes Certificate Templates, click on save button to download the pics for your personal pc. There’re prepared for download, if you like and want to grab it, simply click save symbol in the page, and it will be immediately downloaded in your laptop computer.} As a final point if you’d like to obtain unique and recent graphic related to Hayes Certificate Templates, please follow us on google plus or bookmark this blog, we attempt our best to give you daily update with fresh and new pics. Hope you love keeping right here. For most upgrades and recent news about Hayes Certificate Templates images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to provide you with update periodically with all new and fresh graphics, like your searching, and find the ideal for you.

Thanks for visiting our site, contentabove Hayes Certificate Templates published . Nowadays we’re delighted to declare that we have discovered an incrediblyinteresting nicheto be reviewed, namely Hayes Certificate Templates Lots of people attempting to find specifics ofHayes Certificate Templates and certainly one of them is you, is not it?

:max_bytes(150000):strip_icc()/007-set-up-new-document-certificate-template-1079161-7590efd3228244ca8f5a8670b6ae69da.jpg)