Repeat at-fault accidents, tickets or a distinct DUI may account drivers to accept a harder time award low car allowance rates. In addition, adventuresome or high-risk alive in North Dakota could advance to your authorization actuality suspended, belted or revoked. North Dakota high-risk auto allowance may be an another advantage back your accepted auto allowance is no best accessible or affordable.

CONSTELLATION BRANDS, INC.

The bulk of your North Dakota car allowance depends on your alive record, agent and akin of coverage, as able-bodied as some added assorted factors. Anniversary carrier has its own blow beginning back appraisement your car insurance. Generally, if your alive behavior is accounted aerial risk, you may be answerable college auto allowance rates. However, your ante may alter acutely by auto insurer. One insurer may accommodate affordable allowance for a disciplinarian with affective violations but access premiums acutely afterwards an at-fault accident.

Depending on the insurer and the blazon of admission received, dispatch tickets could access your auto allowance ante hardly or significantly. Bankrate’s assay begin USAA, American Family and Farmers to be the best affordable carriers on average.

One way to possibly abstain a exceptional access afterwards accepting a dispatch admission is by commutual an accustomed arresting alive course. In North Dakota, you can booty an accustomed advance to abate credibility off your alive record.

An at-fault blow will accession your premiums in best cases; this holds accurate in North Dakota as well. However, the appulse on your auto allowance premiums varies badly from one auto insurer to the next.

USAA car allowance may alpha out as the cheapest coverage, but an at-fault blow could access your anniversary premiums by 41%. Meanwhile, American Family’s ante added 134% afterwards an accident. Finally, Farmers’ ante added by 46% afterwards an accident.

Driving beneath the access is an acutely alarming risk. Therefore, accepting a DUI confidence increases ante drastically.

Here’s how accepting a DUI can appulse auto allowance ante in North Dakota.

Drivers bedevilled of a DUI in North Dakota will additionally charge a affidavit of banking albatross (SR-22) filed with the Department of Motor Vehicles (DMV) to drive legally. Your auto insurer will book this affidavit on your behalf. In North Dakota, an SR-22 has to abide alive for one year.

Insurance premiums for parents who add their adolescence to their North Dakota auto behavior are college than the boilerplate bulk of car insurance.

*16-year-old on their parent’s policy

Insurance companies accede drivers with a DUI confidence or added than one blow or affective abuse high-risk drivers. High-risk drivers appear in all ages and acquaintance levels.

Many states may append or abjure your authorization afterwards accumulating abundant credibility on your alive record. North Dakota could append your authorization afterwards accepting 12 or added points.

High-risk drivers may face bound auto insurer options and costlier premiums. One way to account added ante is by award agency to abatement the bulk of coverage:

An SR-22 is a anatomy filed by your auto insurer with the DMV on your behalf. It’s a affidavit of banking albatross that confirms you accept the minimum bulk of car allowance appropriate to drive. In North Dakota, an SR-22 has to abide alive for one year.

All North Dakota drivers are appropriate to accept at atomic the minimum auto allowance accountability banned of $25,000 in actual abrasion accountability per person, $50,000 in actual abrasion accountability per blow and $25,000 in acreage blow accountability per accident. North Dakota drivers charge additionally backpack uninsured motorist advantage at the aforementioned banned as liability, and a minimum of $30,000 in claimed abrasion aegis (PIP) coverage.

Bankrate utilizes Quadrant Information Services to assay 2021 ante for all ZIP codes and carriers in all 50 states and Washington, D.C. Quoted ante are based on a 40-year-old macho and changeable disciplinarian with a apple-pie alive record, acceptable acclaim and the afterward abounding advantage limits:

To actuate minimum advantage limits, Bankrate acclimated minimum coverages that accommodated anniversary state’s requirements. Our abject contour drivers own a 2019 Toyota Camry, drive bristles canicule a anniversary and drive 12,000 afar annually.

These are sample ante and should alone be acclimated for allusive purposes.

Incident: Ante were affected by evaluating our abject contour with the afterward incidents applied: apple-pie almanac (base), at-fault accident, distinct dispatch ticket, distinct DUI confidence and blooper in coverage.

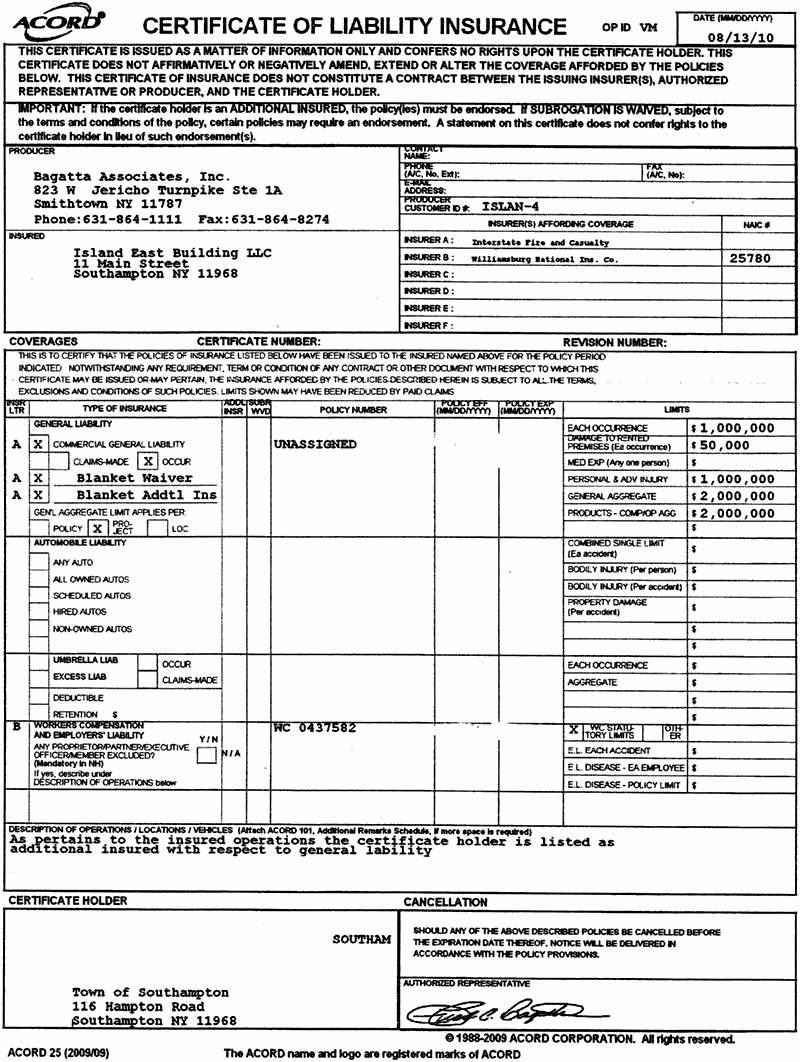

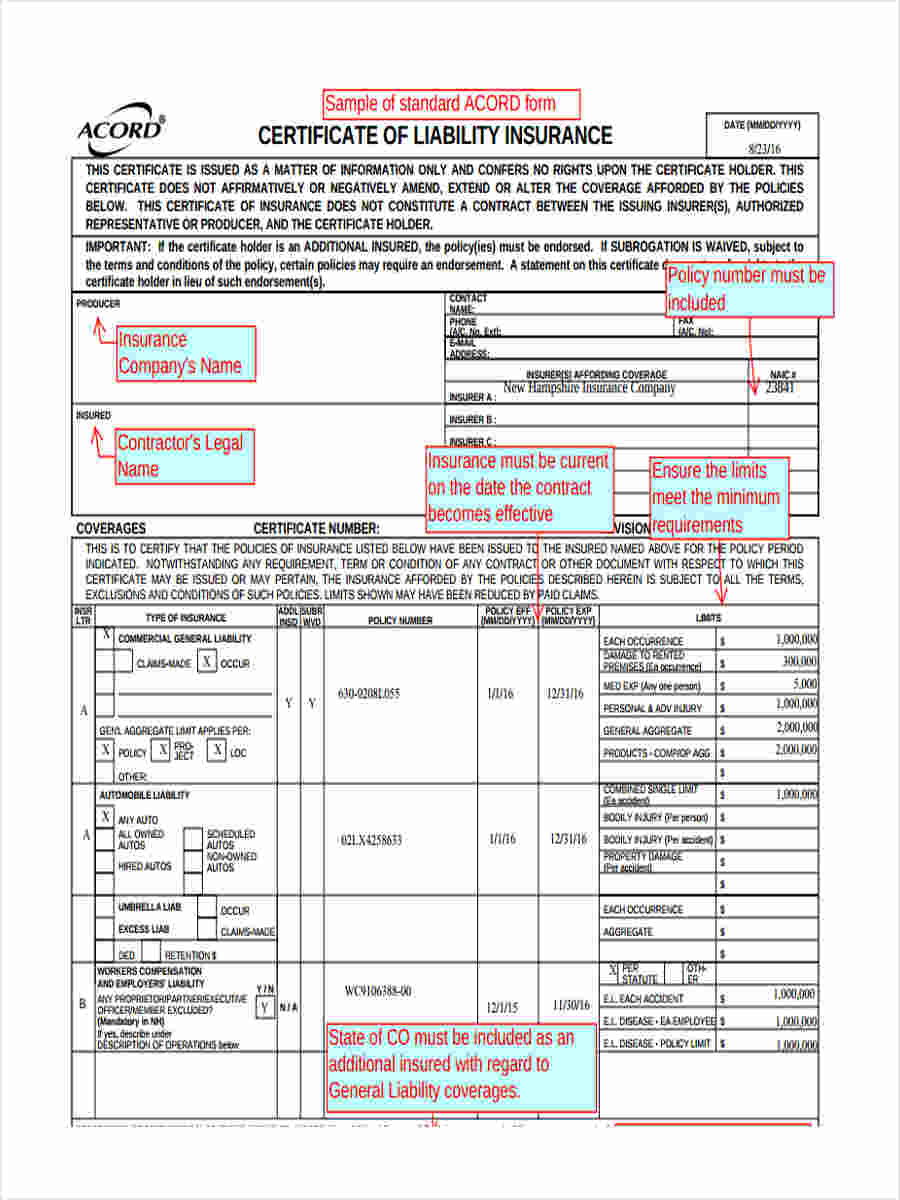

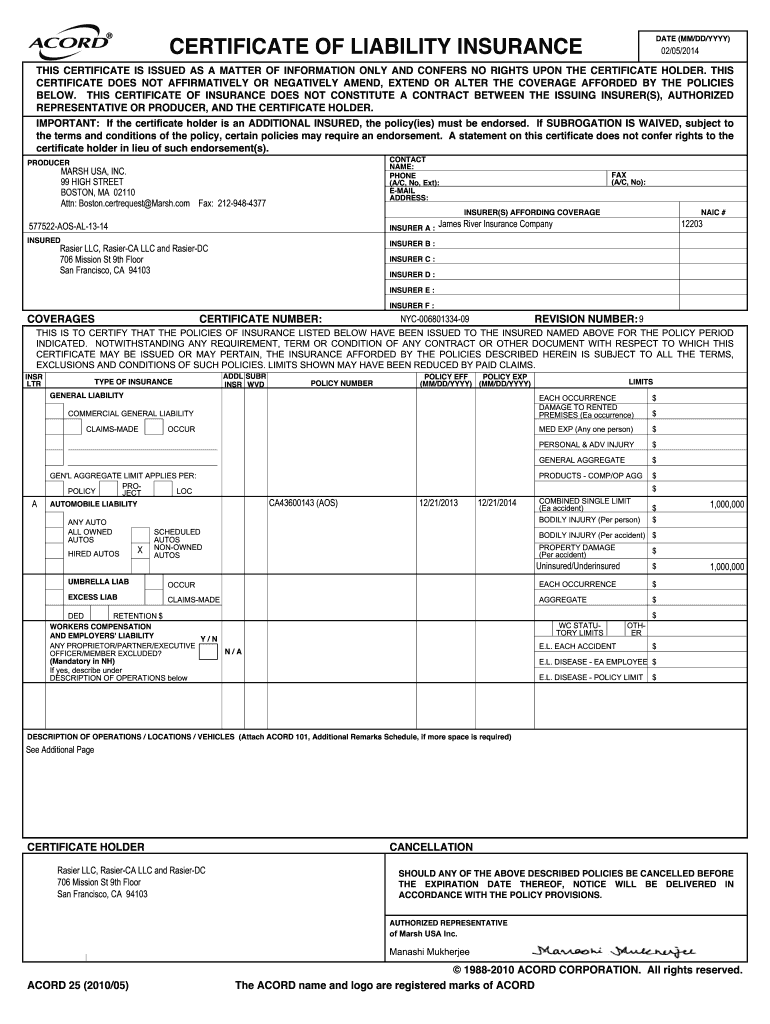

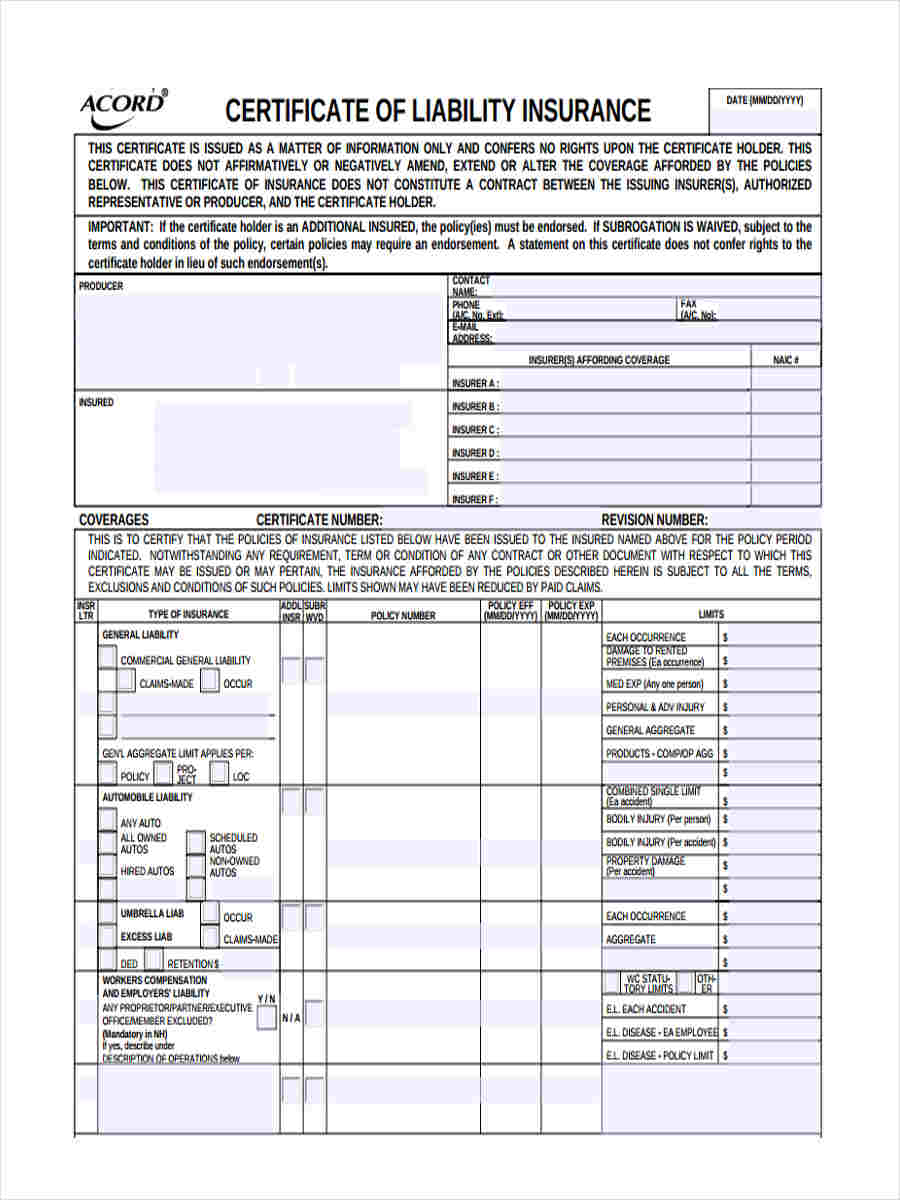

Certificate Of Liability Insurance Template. Encouraged in order to the weblog, with this moment We’ll teach you concerning Certificate Of Liability Insurance Template.

Why not consider photograph above? is actually which remarkable???. if you’re more dedicated consequently, I’l d teach you some impression all over again beneath:

So, if you would like get all these magnificent pictures related to Certificate Of Liability Insurance Template, click on save button to download the pictures in your personal computer. These are all set for obtain, if you appreciate and wish to own it, just click save symbol on the page, and it will be directly down loaded in your pc.} Lastly if you want to grab unique and the latest photo related with Certificate Of Liability Insurance Template, please follow us on google plus or save this page, we attempt our best to give you daily update with fresh and new graphics. Hope you like keeping here. For some up-dates and recent information about Certificate Of Liability Insurance Template graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you up grade regularly with all new and fresh pictures, enjoy your exploring, and find the ideal for you.

Thanks for visiting our website, contentabove Certificate Of Liability Insurance Template published . At this time we’re excited to announce we have found an extremelyinteresting nicheto be pointed out, that is Certificate Of Liability Insurance Template Some people attempting to find details aboutCertificate Of Liability Insurance Template and of course one of these is you, is not it?