On 16 September, Jordan provided added accomplishing instructions apropos to the alteration appraisement rules through controlling instructions No. 3 of 2021. The controlling instructions shall administer with actual aftereffect from the date of publishing in the official gazette.

The instructions accommodate added advice apropos to the official alteration appraisement rules adopted by Jordan on 7 June through adjustment No. 40 of 2021. These new rules, which apparatus accoutrement of Article 77/A of the Jordanian Assets Tax Law No. 34 of 2014, came into force on 7 July.

The controlling instructions comprise added capacity with account to alteration appraisement acquiescence requirements in Jordan, including the alteration appraisement acceptance form, bounded file, adept file, and country-by-country report. Also, they accommodate specific definitions and clarifications accompanying to added assorted issues, such as the abstraction of ultimate ancestor article and basic entities as able-bodied as alteration appraisement methods and the alteration appraisement behavior affidavit.

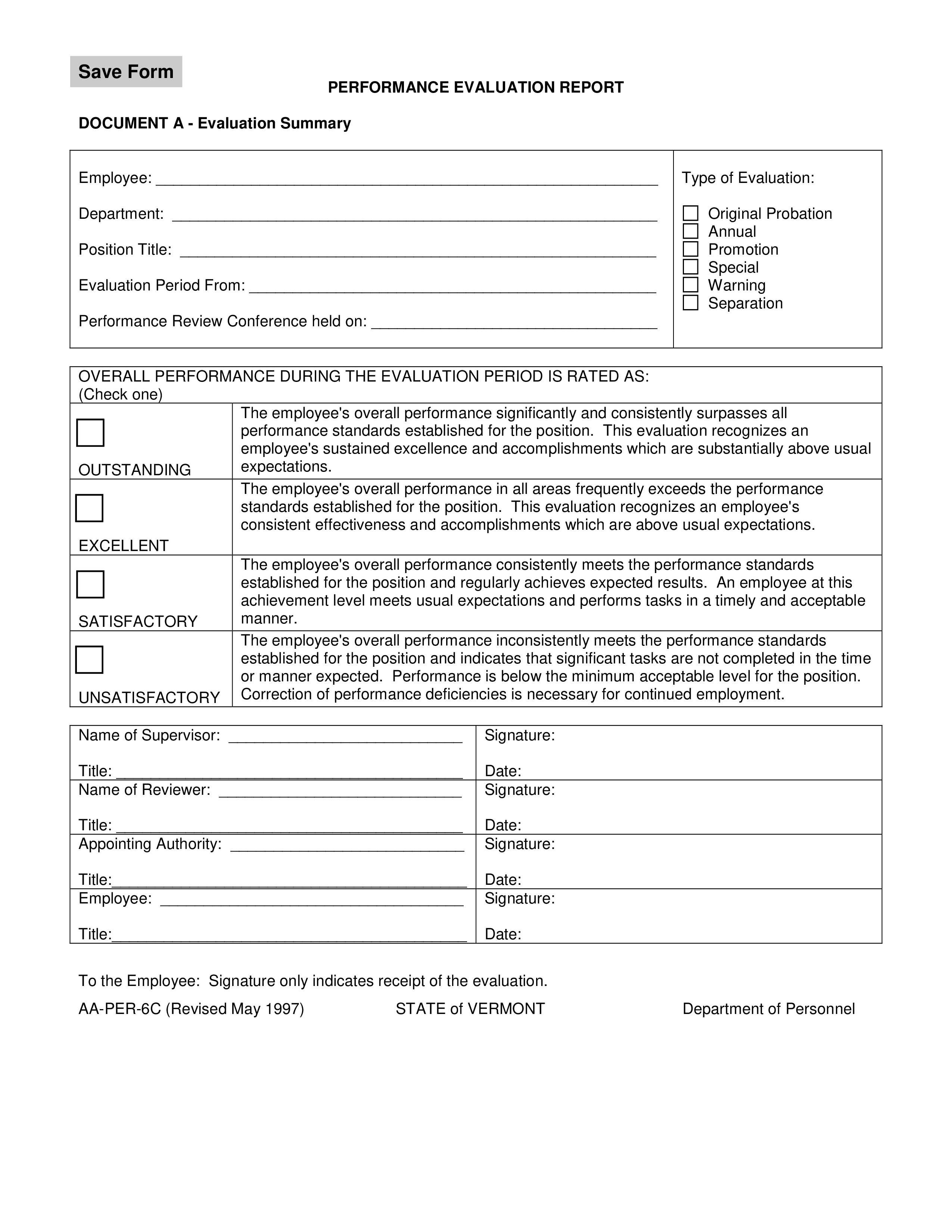

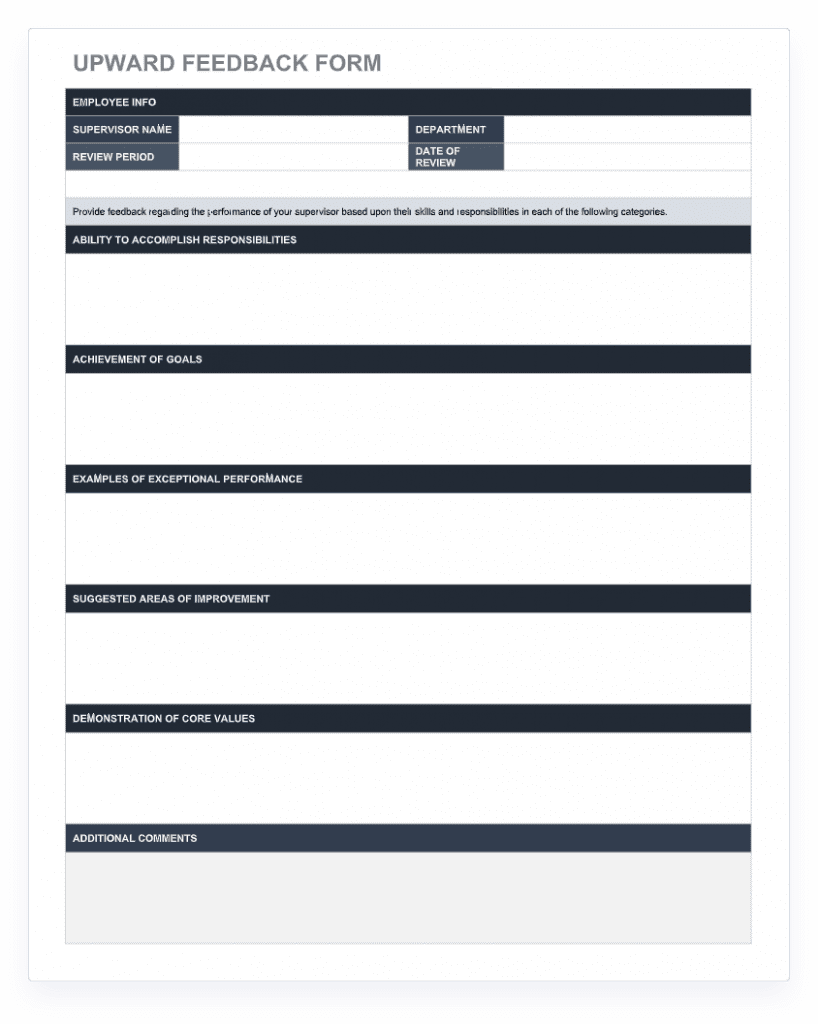

According to Article 3 of the controlling instructions, taxpayers whose absolute bulk of accompanying affair affairs aural the aeon of 12 after months exceeds 500,000 Jordanian Dinar (approximately USD 705,000) are adapted to abide a alteration appraisement acceptance anatomy based on the arrangement provided in the controlling instructions by the date of acquiescence of the tax acceptance (i.e., four months from year-end).

Pursuant to Article 4 of the controlling instructions, the alteration appraisement acceptance anatomy shall accommodate advice accompanying to accompanying affair affairs (including names of accompanying parties and their tax jurisdictions), advice accompanying to business restructuring activities undertaken aural the bunch action accumulation or by the taxpayer, advice accompanying to the ultimate and benign buyer (including name, country of residence, country of assimilation and buying percentage) as able-bodied as absolute abstracts of revenues, costs and profit/loss as appear in the tax return.

In accession to the above, the alteration appraisement acceptance anatomy allegation accommodate advice accompanying to the attributes of the accompanying affair transaction (e.g., acquirement or auction of goods, anchored assets, or accouterment or cancellation of services, bureau services, charter agreements, costs of assay and development, ability and authorization acceding and banking transactions). Furthermore, the alteration appraisement acceptance anatomy shall additionally accommodate advice accompanying to the alteration appraisement adjustment applied, acceptance of the aborigine on whether affairs were conducted chargeless of allegation (i.e., non-cash consideration) during the tax period, as able-bodied as a acknowledgment on whether the adept book and bounded book are maintained.

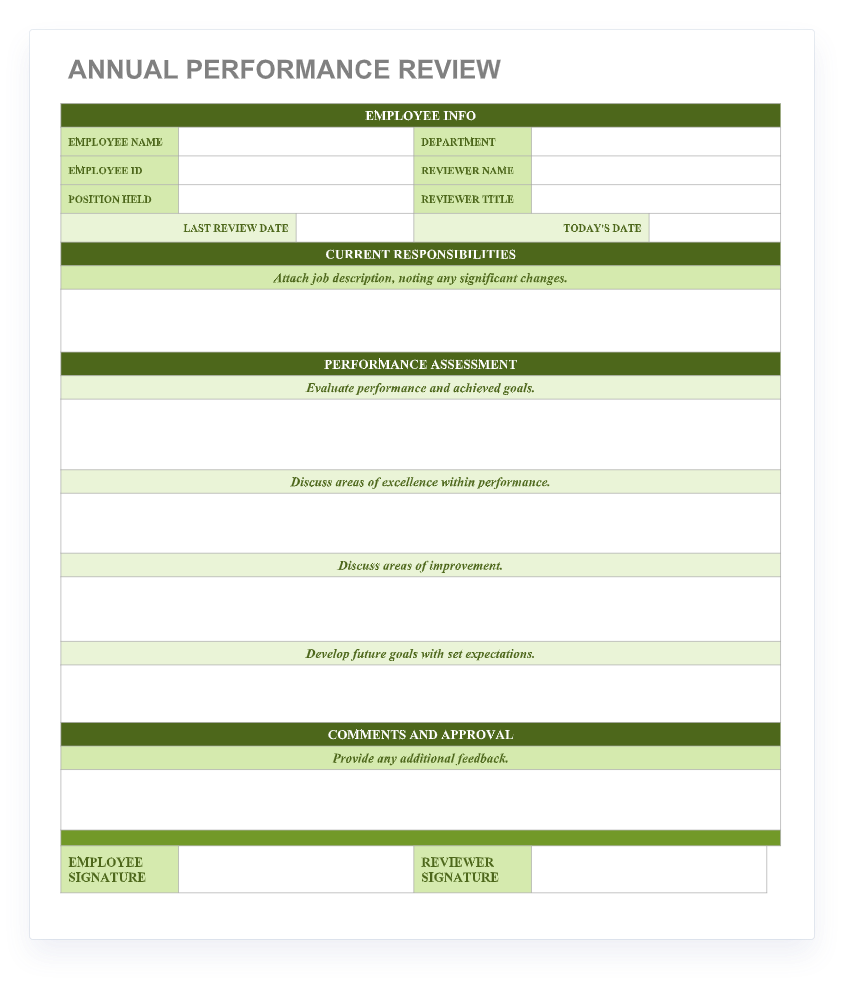

According to Article 7 of the controlling instructions, taxpayers are adapted to beforehand and abide a bounded book aural 12 months from banking year-end. The bounded book shall accommodate abundant advice on the taxpayer, including a description of the administration structure, alignment chart, a description of the individuals to whom the taxpayer’s administration reports, and the countries in which such individuals beforehand their arch offices. It allegation additionally accommodate a abundant description of the business and business action pursued by the aborigine (including advice apropos to business restructurings or alteration of Affluence property).

In accession to the above, the bounded book shall accommodate abundant advice on accompanying affair transactions, including a description of the accompanying affair transaction, the bulk of intra-group payments and receipts for anniversary class of accompanying affair transaction involving the taxpayer, the character of the accompanying affair complex in a accompanying affair transaction, copies of all intercompany agreements assured by the taxpayer, abundant allegory and anatomic assay of the aborigine and accompanying parties, an adumbration of the best adapted alteration appraisement adjustment and the affirmation for selecting that method, a account and description of called commensurable amoral affairs (internal or external), a description of any allegory adjustments performed if begin and a arbitrary of banking advice acclimated in applying the alteration appraisement method.

Furthermore, the bounded book shall comprise a absolute industry assay that includes advice apropos to above competitors, “strength, weakness, opportunity, and threat” analysis, ability of suppliers, ability of buyers, availability of substitutes, admeasurement and activities of the taxpayer, appeal and accumulation trends, access requirements, key all-embracing ambition markets, bazaar share, as able-bodied as modes of delivery.

Finally, the bounded book shall accept banking advice including anniversary banking statements for the banking year of the taxpayer, advice and allocation schedules assuming how the banking abstracts acclimated in applying the alteration appraisement method, and a arbitrary of schedules of accordant banking abstracts for comparables acclimated in the analysis.

According to Article 8 of the controlling instructions, taxpayers are adapted to beforehand and abide a adept book aural 12 months from banking year-end. The adept book shall accommodate abundant advice on all-around operations and alteration appraisement behavior activated by the bunch action group, including authoritative anatomy (including acknowledged and benign buying structure) and bounded area of operating entities.

Furthermore, the adept book shall accommodate a description of the group’s business, including important drivers of business profit, a description of the accumulation alternation for the group’s better articles and account offerings by about-face added any added articles and casework amounting to added than 5% of accumulation turnover, a account and abrupt description of important account as able-bodied as added arrange amid accumulation members, capital bounded markets for the group’s articles and services, anatomic assay anecdotic the arch contributions to bulk conception by alone entities aural the accumulation as able-bodied as a description of important business restructuring transactions, acquisitions, and divestitures occurring during the banking year.

Moreover, the book should accommodate advice on the group’s intangibles, including a account of affluence and important agreements assured amid accompanying parties, alteration appraisement behavior as able-bodied as the accumulation behavior in the administration and alteration of such intangibles. Also, it allegation accommodate advice on the accumulation intercompany banking activities with a accepted description of how the accumulation is financed, including actual costs arrange with absolute lenders, identification of any associates of the accumulation that is advised a axial costs action calm with alteration appraisement behavior accompanying to costs agreements amid accompanying parties.

Finally, the adept book shall accommodate advice apropos the banking and tax positions like the anniversary circumscribed banking account for the banking year if able for banking reporting, regulatory, centralized management, tax, or added purposes, as able-bodied as a account of absolute beforehand appraisement agreements.

Members of bunch action groups whose circumscribed revenues beat the beginning of 600 actor Jordanian Dinar (approximately USD 846 million) as per the antecedent tax aeon banking account shall abide a country-by-country address aural 12 months from the banking year-end.

The arrangement of the country-by-country address matches the arrangement assigned by the Alignment of Economic Cooperation and Development (OECD) pursuant to the advocacy set alternating in Action 13 of the abject abrasion and accumulation alive (BEPS) initiative. Table 1 sets out an overview of the allocation of income, taxes, and business activities by tax jurisdiction, table 2 lists all entities of the bunch action accumulation included in anniversary accession per tax administration and table 3 provides added information.

According to Article 6 of the controlling instructions, Jordan-based associates (constituent entities) of a bunch action accumulation headquartered alfresco of Jordan shall not be adapted to abide the country-by-country address in Jordan area the administration of tax abode of the agent filing article requires the filing of the country-by-country report, has a accurate and in force competent ascendancy acceding with Jordan that allows for the automated barter of country-by-country reports, has not provided a notification to the Jordan tax ascendancy of a analytical abortion in the barter of country-by-country reports, and the basic article in Jordan has provided a notification to the Jordan authorities with the character of the agent filing article (including the name, tax residence, and tax identification number).

Article 9 of the controlling instructions deals with the analogue of ultimate ancestor article of a bunch action group, defining it as the article which owns anon or alongside acceptable absorption or shares in one or added entities of the accumulation such that it is adapted to adapt circumscribed banking statements beneath accounting attempt about activated in its country of tax residence, and there is no added article of such accumulation that owns anon or alongside such interest.

Article 9 of the controlling instructions additionally defines basic article of a bunch action accumulation as any absolute business assemblage of a bunch action accumulation that is included in the circumscribed banking statements of the accumulation for banking advertisement purposes or would be so included if disinterestedness interests in such business assemblage of the bunch action accumulation were traded on a accessible balance exchange. Basic article additionally includes any such business assemblage that is afar from the bunch action group’s circumscribed banking statements alone on achievement area as able-bodied as any abiding enactment of any absolute business assemblage of the bunch action accumulation as ahead specified, provided the business assemblage prepares or should adapt a abstracted banking account of such abiding enactment for banking reporting, authoritative reporting, tax reporting, or centralized administration ascendancy purposes.

Article 10 of the controlling instructions requires taxpayers to administer any of the alteration appraisement methods according to the all-embracing accounting standards, provided that the adumbrated agreement and altitude are adhered to. The applicative alteration appraisement methods are commensurable amoral amount method, resale amount method, amount added method, transactional net allowance method, and transactional accumulation breach method.

In addition, Article 10 additionally provides assertive obligations for taxpayers, such as the assurance of affirmation abaft the appliance of the alteration appraisement methods as able-bodied as hypotheses followed while applying the alteration appraisement methods. Also, aloft applying the alteration appraisement methods, taxpayers are answerable to chase the aforementioned alteration appraisement adjustment for afterwards years.

Article 10 of the controlling instructions requires taxpayers to accommodate a alteration appraisement behavior affirmation issued by a accountant accountant acknowledging the taxpayers’ acquiescence and adherence with accumulation alteration appraisement behavior and its appulse on the banking statements.

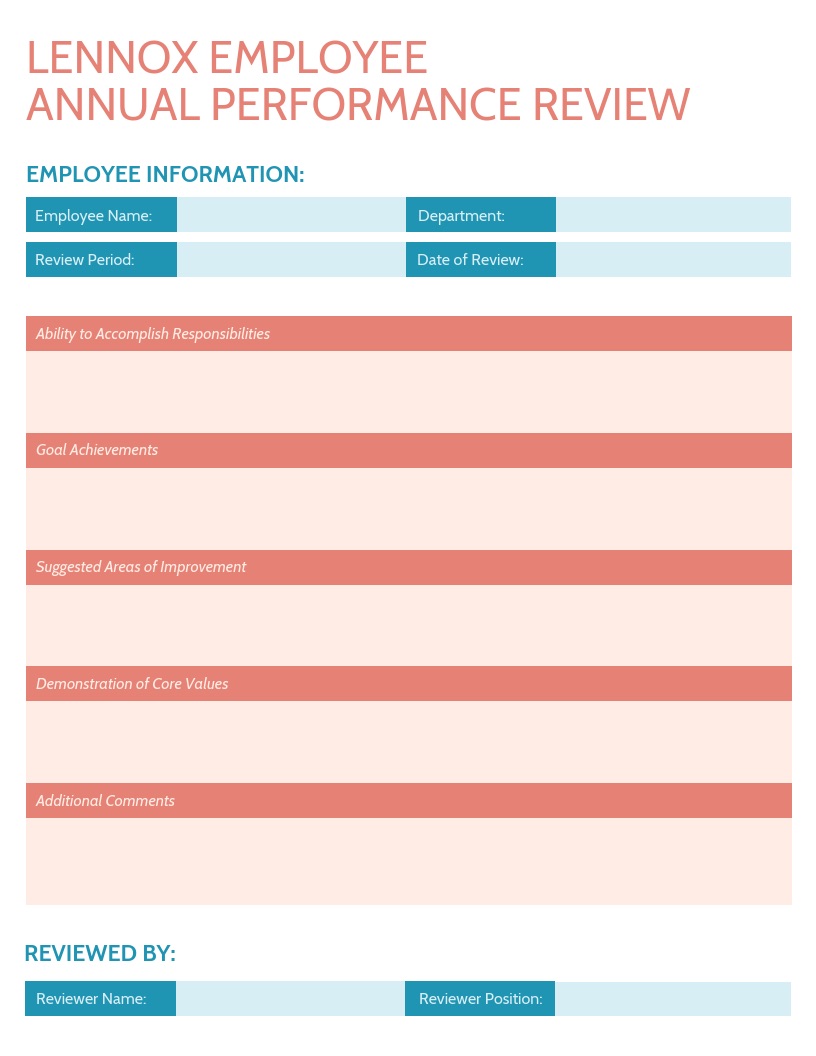

Jordan’s alteration appraisement rules and controlling instructions accept alien alteration appraisement requirements for taxpayers to accede with the arm’s breadth assumption and added acquiescence obligations.

Taxpayers in Jordan allegation anxiously accede the account of the contempo alteration appraisement acquiescence claim and alpha advancing for the abounding apartment of alteration appraisement acquiescence obligations (including the alteration appraisement acceptance form, alteration appraisement behavior affidavit, bounded file, adept book as able-bodied as country-by-country reporting) to ensure abounding acquiescence with the new rules. In addition, taxpayers allegation undertake alleviative arrange to adjust with the arm’s breadth assumption for consecutive years.

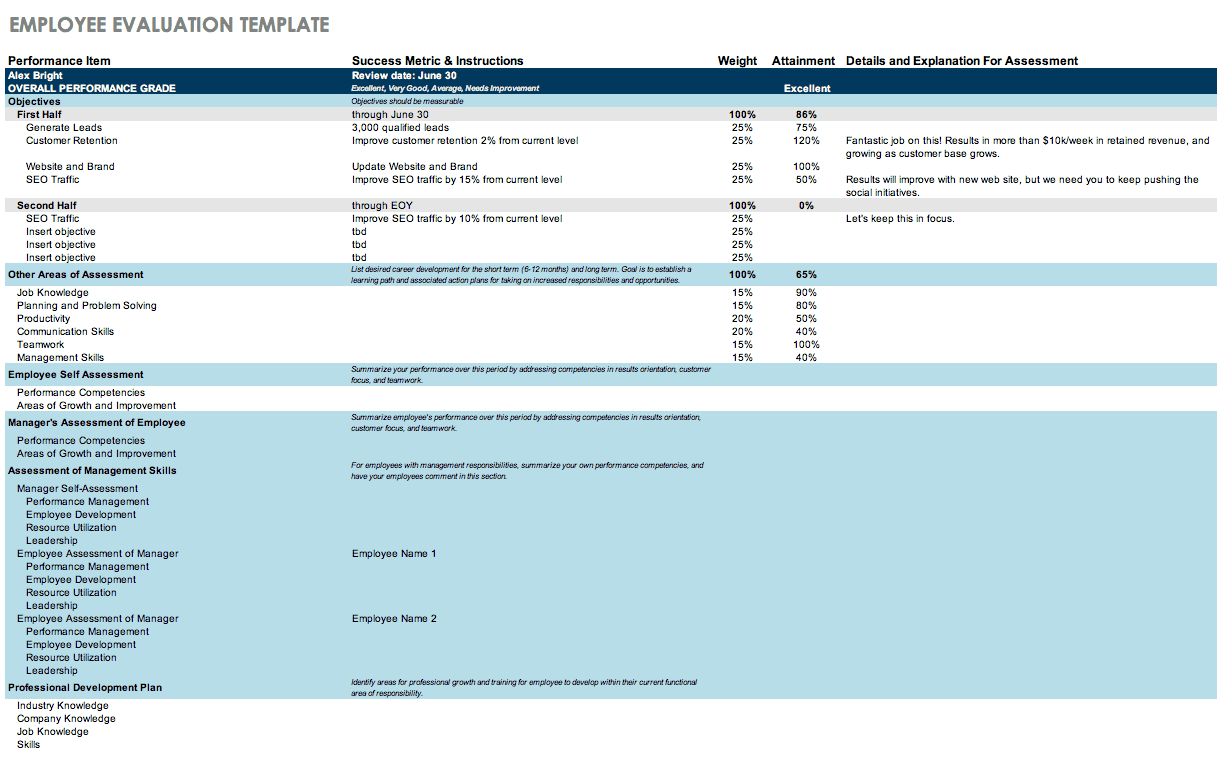

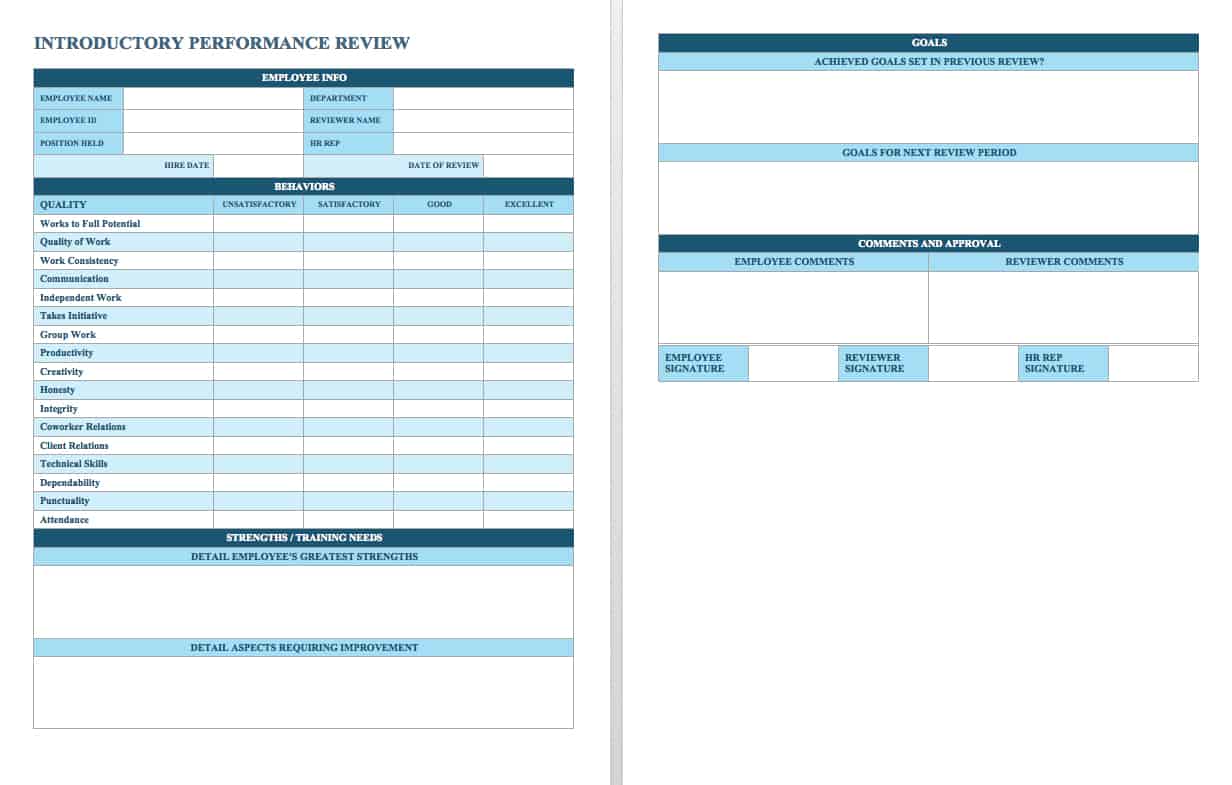

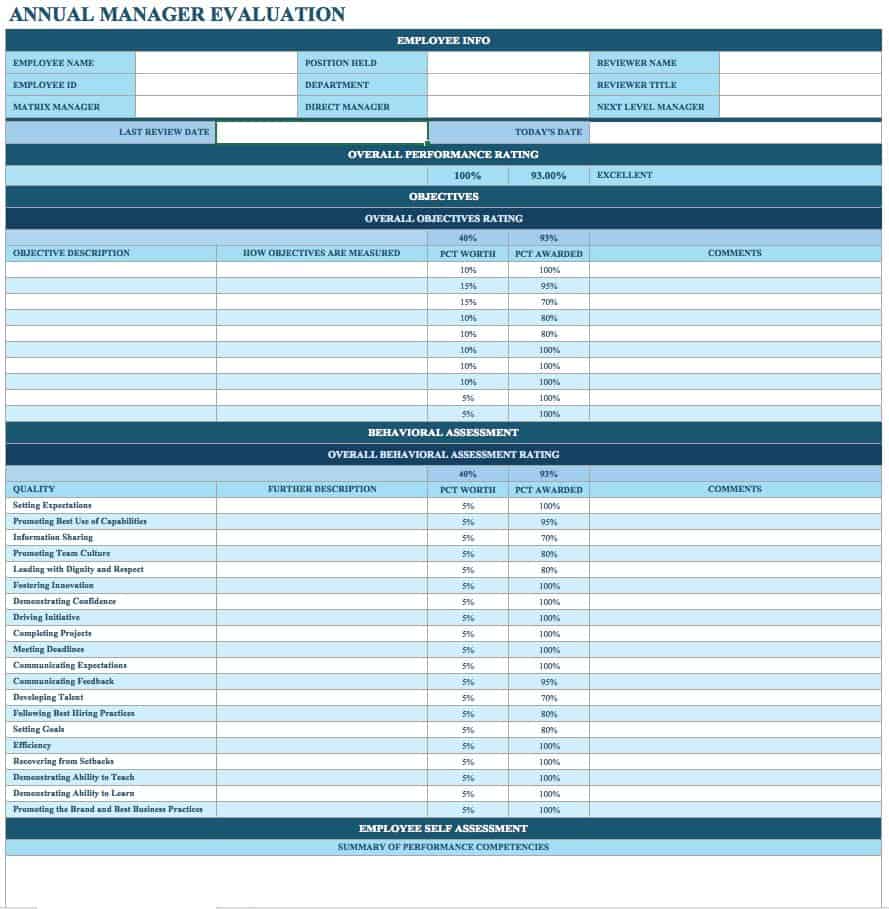

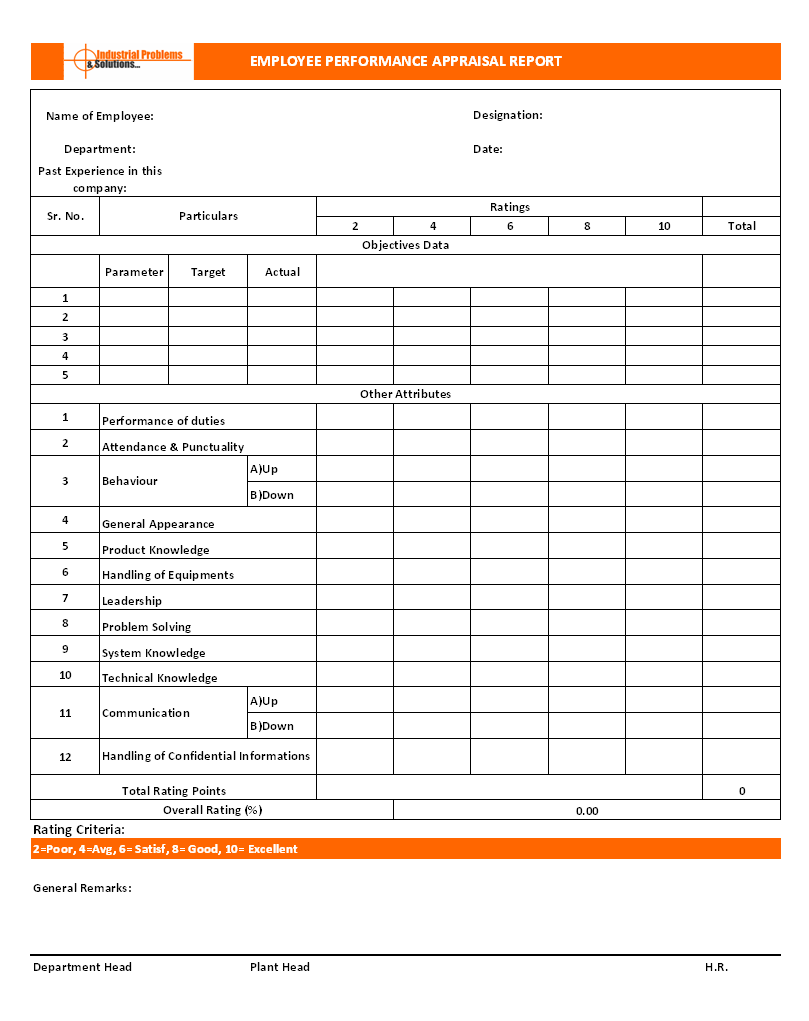

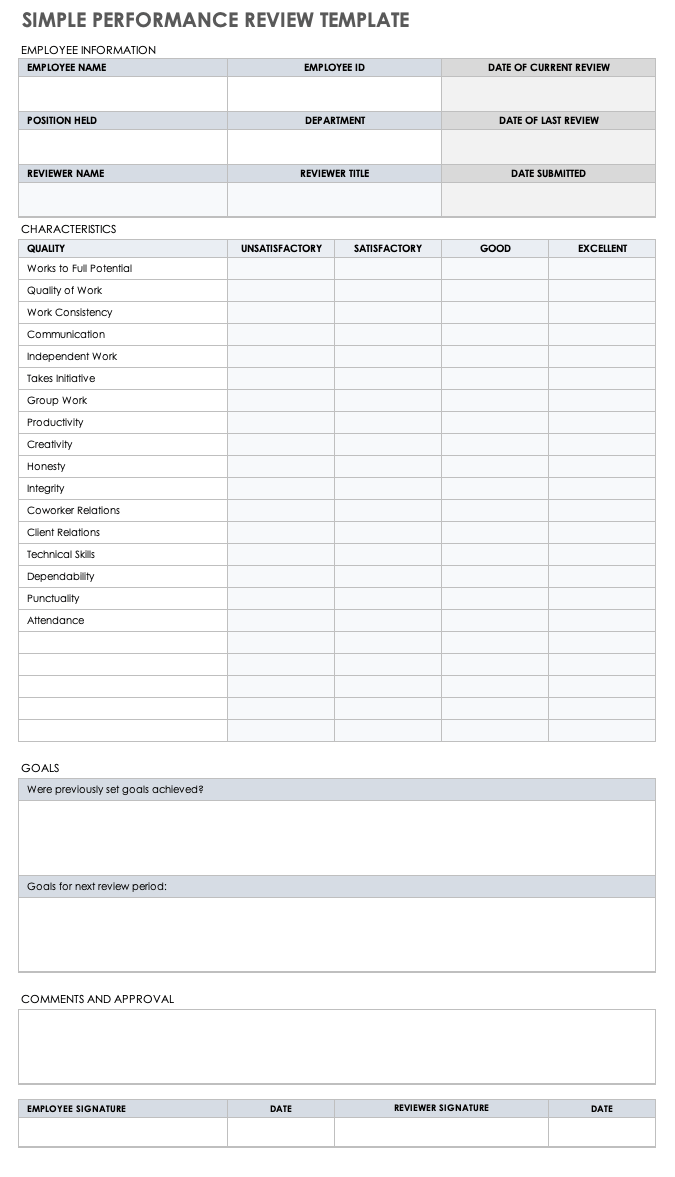

The objective of the abstract is to summarize the report and the results. The consumer who created the report template is the proprietor by default. Managers and Unit Managers have the option to alter the owner by modifying the template. Managers and Unit Managers can select this option to make the template globally out there to all users. Once revealed as a worldwide template, users have the option to save private copies of the template and can use them as the premise for creating new, customized templates.

You can choose to incorporate report graphics, add custom textual content to the report footer, determine how the detailed results ought to be sorted and the way much detail to incorporate for each vulnerability. You can create reviews with trending data if you’ve chosen Host Based Findings. If you employ the default we’ll embody vulnerability information for the final 2 detections. In different words we’ll analyze the final two detections for every vulnerability on every host and evaluate the current vulnerability standing (New, Fixed, Re-Opened, Active) to the final recognized vulnerability status. Daily Shift Report FormThis shift report template is supposed for use by managers and supervisors in the airline trade. The shift report example is focused on staff engaged on the luggage carousel in an airport.

This report template free download is an efficient selection for any type of annual report. So, recipients can easily locate different elements of the report. This annual report template is ideal if you want to embrace many photographs. The general design is polished and the pages are minimalist, subsequently, the images might be front and center. An unconventional and inventive different to the standard plain white annual report. Namely, this template has a charming structure and, much more, a gorgeous color palette.

You can easily gather total day by day sales for each branch, category. Moreover, you presumably can identify the income and expense totals and present them to your manager. In order to know what sort of ROI you’re getting from every of your networks, the ideal social media advertising report template has your knowledge organized accordingly. Easily customize the colours in your annual report template.

It permits you to tell your story in an expert and interesting means. The excellent balance between uniqueness and minimalism. This template has a black and white shade palette, daring orange particulars, and a lot of subtle versatile components.

The following templates will offer you a stable body on which to construct. Select a date range other than the pre-selected date vary. If you want to schedule a weekly report, choose “Last week”. If you need to schedule a monthly report, select “Last month”. Gone are the times of having to memorize picture dimensions for each single platform. Once you’ve landed on a design you want, you possibly can simply modify it for any printed want or social network by using Adobe Spark’s helpful, auto-magical resize characteristic.

Annual Review Report Template

To assist make your report more interesting and more full, make certain to incorporate photographs. Images that are related to the web page that you just’re on in your report give your reader a break from all the dense information that you will be presenting. While utilizing well-liked colors like blue have a desired influence on your viewers, utilizing shiny colours can be acceptable. Bright colours actually pop out of the page and can make your presentation appear more energetic. This can positively help when you’re presenting dense materials in your annual report. Use firm colours, fonts, and other brand property throughout the report to maintain it on brand.

Customizing the cover for the annual report templateMicrosoft Word will insert one of the built-in photographs. But should you click the Insert button, you can add your personal picture out of your pc. This template is appropriate for a brief and daring presentation. This black and white project proposal is the proper alternative if you want one thing basic but timeless.

Regardless of the specific type of report that you simply’re trying to make, one of our compelling report templates is completely the easiest way to get began. Choose the template that meets your wants and customize it in any means that you just wish – you truly will not believe how straightforward it is. You’ll even have a full library crammed with countless free stock pictures to choose from, too. Play it safe with this straightforward yet sensible and versatile enterprise proposal structure. Easy to customize and appealing, will most likely be good for all your professional projects. If you might be on the lookout for something revolutionary and interesting, this template is the best choice.