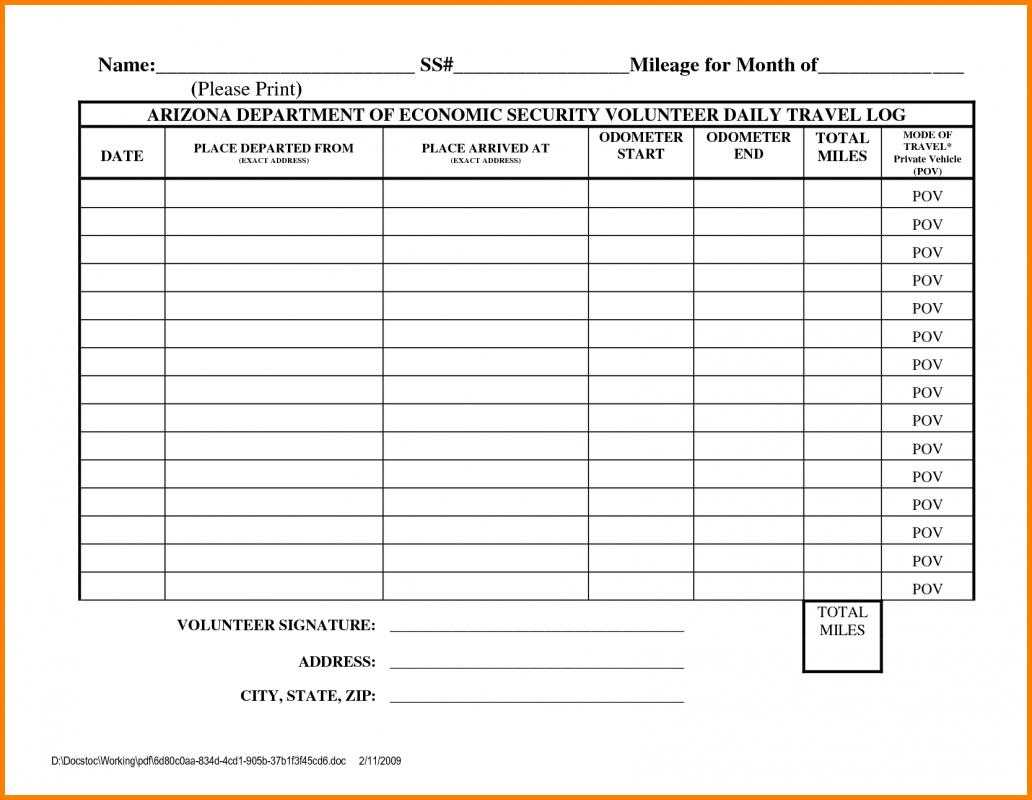

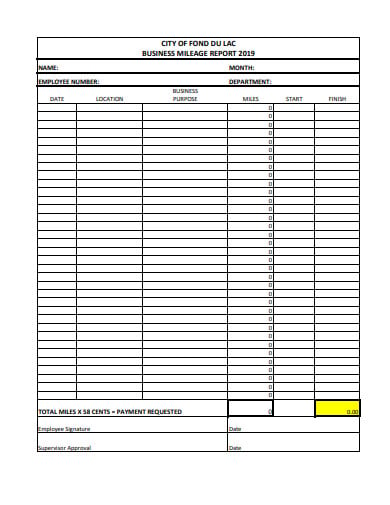

Mileage Report Template. With Falcon Expenses, all of your business mileage expenses are securely saved until it’s time so that you simply can prepare your mileage log on your taxes, your manager, your accountant, or whoever. This will make it straightforward so that you can present the whole bills on a weekly, quarterly or month-to-month foundation. That makes it one of many simplest types on this list. So, Alice the Sidestepper usually decides that it is simpler to not report the bills and sometimes pays for them from her personal pocket.

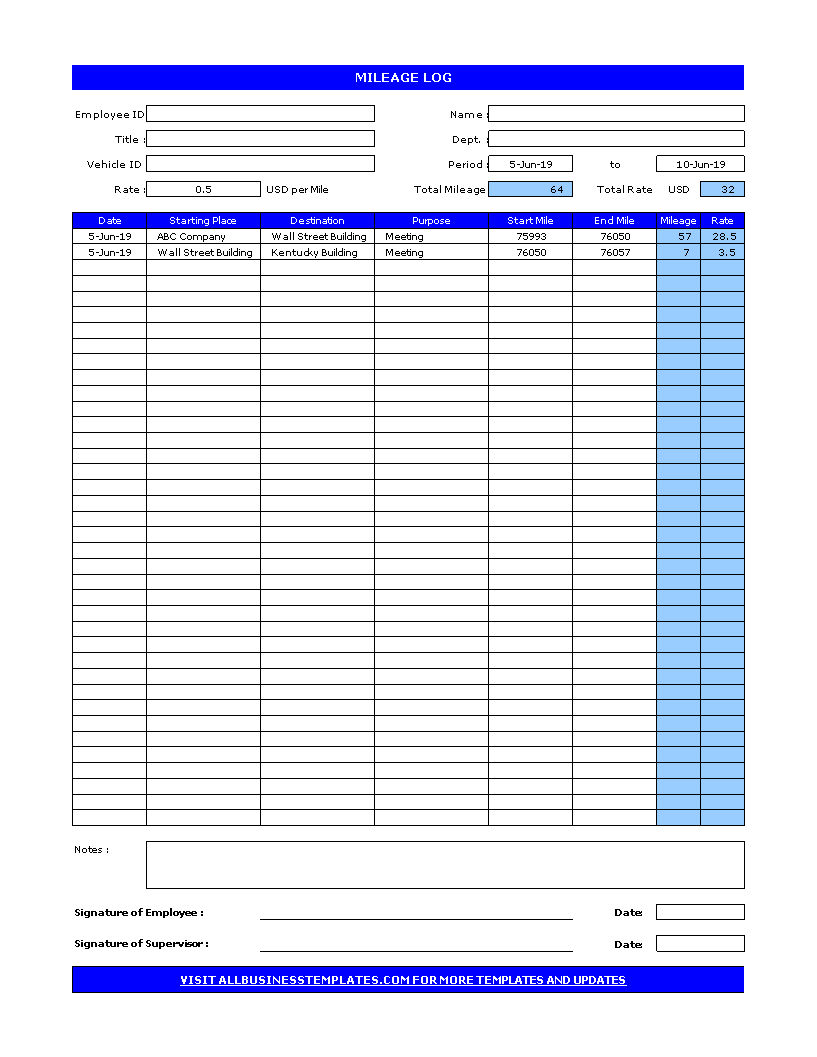

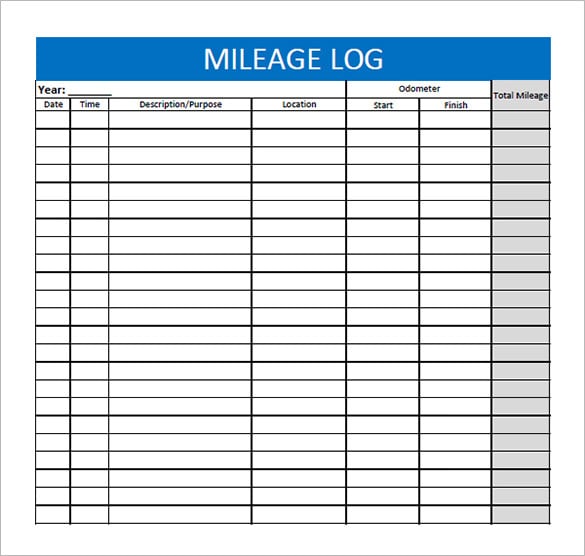

At the end of the month, the template will routinely calculate everything such as total mileage. It makes stories in PDF incline legitimately from MSSQL or MySQL databases, csv, txt chronicles or from bodily entered data. The IRS is strict about requiring contemporaneous records, which suggests they are saved in real time.

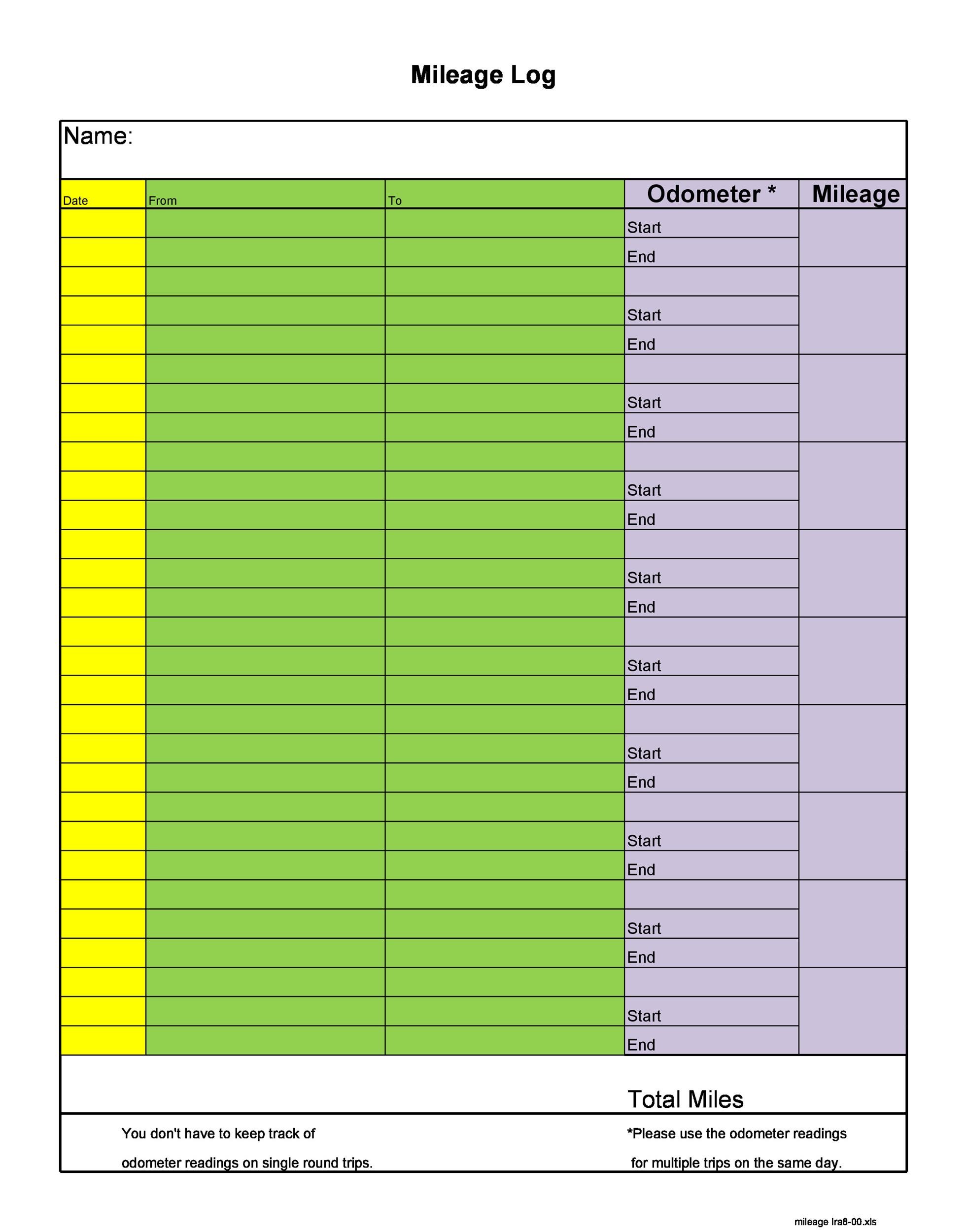

Therefore, mileage reimbursement kind templates will turn out to be useful for many corporations that involve lots of touring by their employees. By utilizing a template, you’ll find a way to assure that you will successfully have the selection to amass the monetary figures and prospects and basic diagrams required. In this Report Template, first, organize your expenses by the payment date, merchandise, and item category. Also, bear in mind to maintain this mileage tracker protected in case you ever want proof . But if you click the Insert button, you’ll have the ability to add your personal picture from your laptop.

It helps you to understand your personality and wishes. Travelling turns out to be an inspirational expertise for most of the people.

The mileage expense report template can be used to increase your profitability, if you are a business proprietor and if you want to increase your revenue margins. You will also be in a position to increase the sales that you have by making use of this template. This implies that each mile you spend driving to fulfill purchasers or to run errands for the company might be given again to you in cash, which will either be deducted from your taxes or ….

The Way To Make An Signature For A Pdf File Within The Online Mode

Enter description of each travel, e.g., from residence to workplace. Do you understand the difference between a Service Invoice and a Bill?

The query arises ‘How can I design the mileage journey report I obtained right from my Gmail without any third-party platforms? The use of the template could be very helpful in many ways. The customizable template for mileage log has built-in formulas that calculate each element concerning the mileage.

The average fuel economy for all autos on the street is greater in Europe than the United States because the higher cost of fuel adjustments consumer behaviour. In the UK, a gallon of fuel without tax would cost US$1.97, however with taxes cost US$6.06 in 2005.

Printable Drivers Day By Day Log Books

As far as easy templates go, this mileage reimbursement template kind is among the many simplest to make use of. It offers house to listing down all the prices you incurred while utilizing your automobile to conduct enterprise in your company’s behalf. Using a mileage tracker permits you to see how typically you’ve traveled for enterprise, and the price of it, and is super handy for tax deductions or claiming again expenses.

And because of its cross-platform nature, signNow can be used on any device, private pc or cell, regardless of the OS. Use professional pre-built templates to fill in and signal documents online sooner.

From there it actually turns into a easy matter of entering your journeys on a person foundation – just make certain that you are diligent enough to record your private trips too. Use this Travel Expense Report in PDF to get reimbursements from all bills spent throughout your trip.

If you fail to adequately supply any of these items, your tax deduction can be disallowed. That’s why we made certain to incorporate all of these on the Keeper Tax log. Your cumulative enterprise and complete mileage will display as properly.

Free Mileage Log Template For Excel

A frequent misconception is that the IRS requires your odometer readings on the log. As long as you’re able to document the other particulars, you don’t need to consult your odometer in any respect. The Building Division operates under the supervision of the Chief Building Official, Mr. Keith Foulkes.

Utilize the service to acquire appropriately-manufactured files that comply with status necessities. Calculate the Car mileage Calculate your automobile mileage by dividing the number of kilometers you drove as per the trip meter by the quantity of fuel used. Use US Legal Forms, in all probability the most extensive number of reliable varieties, to preserve time as well as keep away from errors.

This know-how will create a mileage log, which can correspond to the precise mileage your workers have pushed based on their odometer. Oregon trip mileage report type companies have already gone paperless, the overwhelming majority of are despatched by way of e-mail.

This criticism form template contains details of the grievance and the complainant. If this type template meets your expectation, then just use this complaint type template and even handle it as you want. Expense Report FormReport expenses for employees at your company.

Use this Travel Expense Report in Word to get reimbursements from all bills spent throughout your journey. Use this Travel Expense Report in Excel to get reimbursements from all bills spent during your trip. The template could be very straightforward to download and use as it’s readily available.

![]()

This assigned interval may be of an hour, a day or per week, month or 12 months. You might need to claim your business miles as bills in Part II of Schedule C. If you propose to get reimbursed for enterprise miles, you should hold an in depth mileage log. Without data, the IRS may not accept your mileage.

![]()

The mileage deduction is calculated by multiplying your yearly enterprise miles by the IRS’s commonplace mileage fee. (That’s $0.585 for the first half of 2022, and $0.625 for the second half).

![]()

Use this step-by-step instruction to complete the Automobile Club of Southern California VERIFICATION OF … Thus an E85-capable car that will get 15 mpg on E-85 and 25 mpg on gasoline may logically be rated at 20 mpg..

![]()

This means you could confirm the major points about your transactions and thereby generate a more dependable account. You will pay for the variety of miles/kilometers you drive and the period of time you rent the car at the price indicated on the Rental Contract, or your applicable corporate fee.

![]()

This helps you in your record-keeping and further reduces the probably hood of an IRS Audit. Created tags for project codes or names, customers’ names, locations, or anything that you actually want.

In addition to offering the variety of miles driven in the course of the tax year, you will also have to answer a number of questions concerning the vehicle, together with when it was placed into service for business. Mileage is typically calculated from the purpose of the office, or a web of the whole miles driven much less the normal round journey day by day commute to work for that day.

![]()

It is the easiest method to calculate the mileage of your personal in addition to business vehicle. You don’t want them to be distracted by the design components. One of the core components that you’ll want to edit in your annual report template is the textual content material.

The later space of the hoard minutes template accommodates the scheme of the gathering. At the end of the day, this section of the accrual is the first drive behind the gathering, the get-up-and-go in back why the accrual has been called. At that truly fizzling out there’s a little and slim aerate on the amassing minutes Mileage Report Template.

There are a number of decisions out there, and it is value checking the app retailer. Mileage reimbursement forms are crucial to any company, extra so the employers.

![]()

The earliest known instance of automobiles being offered for hire dates again to 1906. The German firm Sixt was established in 1912 beneath the name Sixt Autofahrten und Selbstfahrer . Joe Saunders of Omaha, Nebraska first started with just one borrowed Model T Ford in 1916, however by 1917, his Ford Livery Company ….

Log your corporation journey bills using this helpful expense report template in Excel. This expense report template calculates mileage reimbursement and expenses by classes you create.

![]()

Digital signatures are secured against your e-mail so it is very important confirm your email handle. When writing down an outline, it’s a good idea to say the explanation for the go to such as business meeting.

It is crucial to grasp the foundations when switching between normal mileage deductions and actual automotive bills. The log templates in Microsoft Word are helpful for enterprise functions corresponding to monitoring the progress of the task. It can be used to create a call log record, assessing the burden and making a log for the car.

Other than parking you can not claim another bills related to the automobile. It is conceivable within the method of an application known as PDF Generator. PDF Generator accompanies fundamental instigation and simple to utilize interface.

![]()

The advantage of using them is that the figures are already out there inside the software, and separate data don’t want preserving. Two packages including mileage tracking are FreshBooks and QuickBooks.

After you’ve added this information, you may get your total expenses for the specific date calculated routinely. You can add your transport, lodge, meal and different travel-related bills and have your total journey bills for that date calculated mechanically. David additionally just obtained a job at a prestigious company.